Key Insights:

- Bitcoin fell below $116,000 and triggered over $585 million in long liquidations across the crypto market.

- Ethereum outperformed despite the drop and was buoyed by positive ETF sentiment.

- Memecoins and altcoins saw extreme volatility, with some tokens swinging over 50% in value.

Bitcoin’s price took a dip below $116,000 on Friday. This kickstarted a major wave of liquidations across the crypto market, and within 24 hours, over 213,000 traders were liquidated.

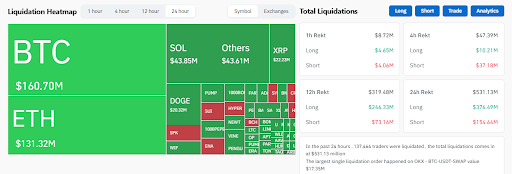

This trend amounted to nearly $600 million lost, most of it from bullish leveraged positions.

According to data from CoinGlass, Bitcoin was responsible for $140 million in liquidated longs, as the price dropped 2.63% to a low of $115,356. The downturn also hit Ethereum and altcoins hard, even though some assets like ETH showed surprising resilience.

A Leverage Flush That Caught Traders Off Guard

The drop in prices shocked many traders who had become bullish after Bitcoin’s recent all-time high of $123,100, just days before. According to popular trader Ash Crypto, the sudden plunge was “a pure leverage flush.”

As Ethereum started to surge earlier in the week, many traders piled into long positions on altcoins. Market makers likely saw the overcrowding and dumped assets, which triggered cascading liquidations. The general market saw total liquidations of more than $731 million, as long positions were wiped out across the board.

Interestingly, Dogecoin was one of the worst-hit among top cryptocurrencies, after falling 7% to $0.22 and causing $26 million in liquidated longs.

Ethereum Shows Strength Amid Bitcoin’s Decline

While Bitcoin stumbled, Ethereum showed surprising strength. The cryptocurrency climbed as much as 1.65%, hovering near $3,700 by Friday.

ETH’s performance indicates that not all crypto assets are strongly correlated to Bitcoin, especially during market turbulence. Institutional interest and ETF activity gave Ethereum a major boost, even as other tokens struggled.

At the time of writing, Ethereum holds a 10.4% share of the total crypto market, despite a 4.4% dip in overall market cap.

Interestingly, Galaxy Digital CEO Mike Novogratz recently stated that he expects Ethereum to hit $4,000 soon on the back of strong fundamentals and increasing institutional demand.

Altcoins reacted violently to the selloff in general. Many of them crashed strongly, while others gained massively. Memecoins, in particular, took center stage, and even large-cap coins like Binance Coin (BNB), Solana (SOL), and Dogecoin (DOGE) saw mixed results.

Market Sentiment Still in “Greed” Despite Red Charts

Interestingly, the Crypto Fear & Greed Index remained firmly in the “Greed” zone at 66 despite the sharp selloff.

Traders still believe in the uptrend, and Bitfinex analysts recently projected that Bitcoin could still reach $136,000. However, they also warned that such levels could represent a local top, as euphoric sentiment often leads to overheated conditions.

Some traders are hedging their bets. If Bitcoin rebounds to $119,500, approximately $3.07 billion in short positions could be liquidated, which might trigger another wave of volatility.

Overall, the crypto market’s recent plunge below $116,000 may have shaken out overconfident traders, but it hasn’t dented long-term optimism. Ethereum is still rising thanks to ETFs, and this could be a mere temporary setback in an otherwise bullish year.