ETF outflows and leverage flush signal de-risking, while liquidity remains key to trend reversal.

Nearly $910 billion has been wiped off the crypto market in just 30 days, marking one of the steepest drops in years. And as expected, the heavy sell-offs have triggered a cautious sentiment among institutional and retail traders. As volatility increased, leveraged positions were liquidated across major exchanges.

Institutional De-Risking Drives Bitcoin ETF Assets Down to $87B

Bitcoin and Ethereum suffered during the market drop. Interestingly, smaller altcoins bore the heaviest brunt, with most tanking over 40%. Investors quickly exited positions as fear engulfed the market.

🔥 UPDATE: The last 30 days wiped out $910B from the crypto market. pic.twitter.com/1yYLdeVyPc

— Cointelegraph (@Cointelegraph) February 14, 2026

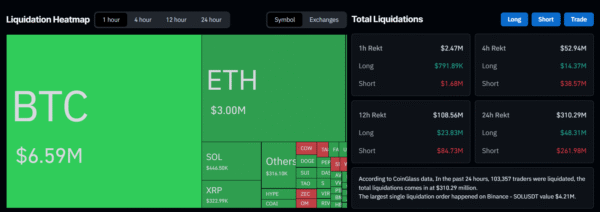

More than $310 million in derivative positions were wiped out within 24 hours at peak volatility. Over 100,000 traders saw positions erased during that period. Short liquidations dominated the most recent flush, following an earlier wave of long-side capitulation. Basically, short positions were forced to close as prices briefly bounced.

Image Source: CoinGlass

Macro factors such as rising interest rates and tighter monetary policy drove the recent market slide. In response to market volatility, investors have pushed capital toward safer assets. Oftentimes, risk-heavy sectors such as crypto are the first to react to this liquidity shift.

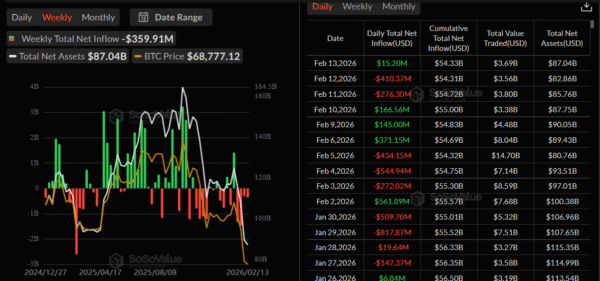

Whale activity and institutional selling also intensified the downturn once momentum turned negative. Spot Bitcoin investment vehicles recorded heavy net outflows over the past two weeks.

Several single-day withdrawals exceeded $400 million and weekly net flows fell by nearly $360 million. Total net assets dropped from about $115 billion to $87 billion. Data points to systematic de-risking among large capital allocators.

Image Source: SoSovalue

Profit-taking also contributed to the drop, as many investors capitalized on months of early gains. Stop-loss orders and trading bots increased selling after prices fell below key support levels.

Crypto Capital Rotation into BTC Fails to Signal Strong Fresh Inflows

As per TradingView data, Bitcoin dominance traded within the 58%–59% range during the downturn. A brief break above 60% indicated capital rotation into BTC as a defensive move. However, failure to sustain that level signaled limited fresh inflows into the market. Meanwhile, altcoins continued to underperform and absorb most of the selling pressure.

Image Source: TradingView

Market signals currently remain mixed structurally. Institutional outflows confirm risk reduction. Conversely, a sharp decline in open interest and a recent short squeeze indicate that excess leverage has largely been flushed out. Historically, similar deleveraging phases have preceded stabilization periods.

Essentially, liquidity remains a primary catalyst for a potential trend flip. ETF net flows, funding rates, and macro indicators will shape short-term momentum. In the absence of renewed institutional inflows, upside potential could remain constrained.

Even so, blockchain development and network activity continue across major ecosystems. Long-term participants view correction as part of the broader market cycle rather than a structural breakdown.