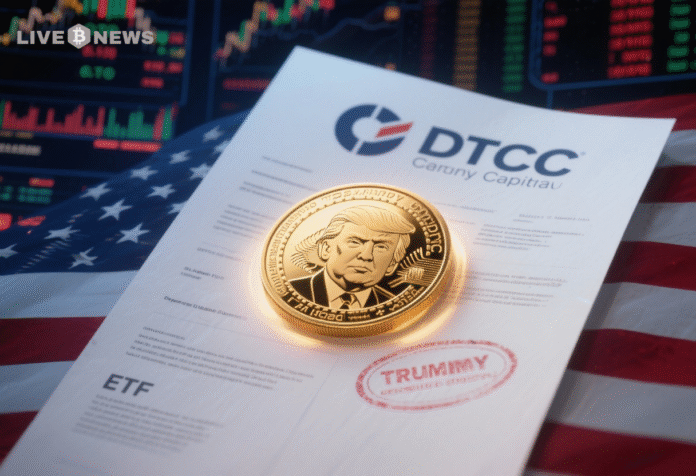

Canary Capital’s Trump Coin ETF is listed on the DTCC, with experts predicting a price breakout as institutional interest grows.

Canary Capital’s Trump Coin ETF (TRPC) has been officially listed on the Depository Trust & Clearing Corporation (DTCC). This development positions the meme coin for wider institutional access and signals growing interest in meme-based digital assets.

While the U.S. Securities and Exchange Commission (SEC) continues to review the ETF, experts predict that the token could experience a price breakout following its listing.

Trump Coin ETF Listed on the DTCC

The Trump Coin ETF (TRPC), managed by Canary Capital, is now listed on the DTCC platform. This is an essential step for financial products before they can be traded on the market. The listing comes after the ETF’s registration in August and reflects the increasing traction of meme coins in institutional markets.

Currently, the SEC is still evaluating the proposal for the Trump Coin ETF. As the SEC assesses public comments and feedback, it is unclear when a final decision will be made. However, the appearance of the Trump Coin ETF on the DTCC platform could mean that it is a step closer to approval.

The DTCC’s role in this process is crucial, as it handles trade clearance, settlement, and share creation for ETFs. Its involvement signals the product is progressing through necessary financial procedures.

Market Analysts Predict Price Breakout

Experts have been closely monitoring the price movements of Trump Coin following its ETF listing.

According to a recent analysis by crypto analyst Mr. Albert, the token has been consolidating near key support levels. The expert suggests that if the $7.00 support zone holds, the coin could experience a strong upward movement.

The analysis points out that the Trump Coin has bounced back from its $7.00 support level and is showing signs of a potential rally.

If the price moves above $7.80–$8.00, analysts believe it could confirm a reversal. This analysis has increased interest from traders looking to capitalize on a possible price surge.

Institutional Interest and Increased Trading Activity

The listing of the Trump Coin ETF on the DTCC could also drive more institutional interest in the meme coin.

As the ETF is processed, it will provide traditional investors with a pathway to gain exposure to Trump Coin without holding the token directly. Experts believe that the regulatory stance on meme coins could improve if they are classified as commodities rather than securities.

Furthermore, the announcement of Fight Fight Fight LLC’s plans to raise $200 million for a Trump Coin treasury has contributed to the growing momentum. This initiative aims to buy a substantial amount of Trump Coin to stabilize its value.

The treasury project has already spurred increased derivatives activity, with open interest in Trump Coin reaching $350.91 million, according to Coinglass data. This uptick in trading volumes across major exchanges like Binance, Bybit, and OKX indicates strong market interest.