Japan’s rising bond yields rattle global markets, strain the yen carry trade, and heighten risks for Bitcoin and crypto assets.

Japan’s sharp bond yield surge has drawn global attention over the past week. The jump unsettled traders across several markets and created debates about liquidity risks.

The rise also came during a fragile moment for digital assets which sit on shaky ground after slower flows into major crypto investment products.

Japan’s Yield Shock Reshapes Market Expectations

Japan startled global investors after its long-dated government bond yields climbed to levels not seen since the bonds first appeared.

The 40-year yield jumped to 3.697%, while the 20-year yield stood at 2.80%. The 30-year yield reached 3.334% and even the 10-year yield increased by 70 basis points over the past twelve months.

These moves followed Tokyo’s plan for a stimulus package worth more than 17 trillion yen, equal to roughly 110 billion dollars.

Many investors expected lower yields after such an announcement and several analysts pointed out that bond markets usually respond to fiscal support by pushing yields down.

Instead, traders pushed yields higher. Shanaka Anslem Perera said the spike reflected doubts about the government’s ability to sustain its debt load. Japan now faces debt levels around 250% of its GDP, and interest costs already consume nearly a quarter of annual tax revenue.

A Strain on the Yen Carry Trade

The yield jump has also rattled one of the largest trading structures in global finance.

For decades, the yen carry trade allowed investors to borrow cheaply in yen and direct the funds toward assets that deliver higher returns. Low rates in Japan made this strategy easy to maintain.

Rising yields increase funding costs and raise currency risks for anyone using yen loans, while higher domestic yields often push the yen higher as money flows back home.

Several analysts expect the yen to strengthen by roughly 4 to 8% over the next six months. So far, a stronger currency raises repayment costs for overseas borrowers.

This part of the market supports an estimated 20 trillion dollars in global positions. If funding becomes expensive, many positions could unwind. Forced selling can spread across stocks, bonds and currencies.

Global Liquidity Stress Reaches Crypto

So how does this affect crypto?

Rising Japanese yields can draw capital away from overseas markets. Investors often reduce foreign exposure and return funds to Japan when domestic yields rise.

This type of trend would reduce support for several markets at once. US Treasuries, equity ETFs and emerging market securities often feel the pressure first.

Therefore, crypto could be at risk.

Liquidity plays a large role during these adjustments. When liquidity tightens, many investors move toward safer positions. Several analysts believe that the current environment resembles earlier periods where global liquidity withdrawals led to massive price dumps across risk assets like crypto.

Related Reading: Japan Is Reportedly Considering A Tighter Crackdown On Crypto DATs

Pressure Builds for Bitcoin and the Crypto Market

Japan’s rising yields could make domestic bonds more appealing than foreign assets.

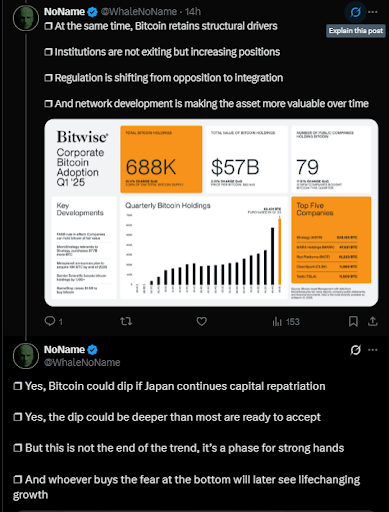

If this happens, it may reduce demand for risk-driven investments. Many traders already watch reduced inflows into major Bitcoin ETFs and cooler activity among institutional buyers.

Higher yields often support a stronger dollar and a firm dollar tends to weigh on assets that rely on global liquidity, including Bitcoin. Analysts have observed similar patterns during 2015, 2018 and 2022 periods when liquidity conditions tightened.

Bitcoin weakened during these times, not because traders lost interest, but because cash was pulled out of risk markets.

A sharp unwind in yen-funded positions could lead to another wave of selling across several asset classes. Crypto assets usually react early during such periods and Bitcoin might face more pressure if things worsen further.