The price of Pi Network dropped more than 90% off the peak, and rug pull so claims emerged as the network lost 18B of value. Shareholders are floundering with the lack of liquidity and insider issues.

The price of the token of the Pi Network has fallen more than 90 percent since its peak in February 2025, with the launch of the mainnet. In six months, this dramatic decline erased over 18 billion of market value.

Source –X

Many investors who mined Pi instead of purchasing tokens have suffered a gruesome loss despite their initial excitement. The token price is currently around 26 cents, compared to the highs of about 3 per Pi.

This sharp crash has brought back allegations by sections of the community that the downfall of Pi Network is similar to a rug pull.

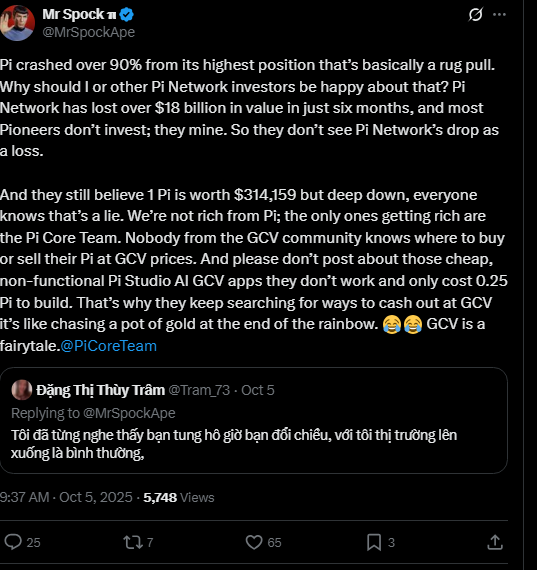

A social media analyst popularly termed the crash a rug pull, noting that the only winners seem to be the Pi Core Team, but not average users who mined tokens over the years.

Users report that there is a lack of liquidity, and it is practically impossible to sell Pi at the official prices proclaimed by the project. This has caused investors to seek elusive returns in what some may term a fairy tale ecosystem.

Pi Core Team and Insider Selling Scrutinized

The Pi Core Team holds a significant amount of tokens (around 90 billion coins), which can be centralized.

Concerns are that insider selling of tokens has occurred behind the scenes, which has also led to the fall in pricing.

Blockchain data in recent months indicates that large volumes of tokens have been sold, a fact that adds to skepticism about the existence of an insider dump plotting the fall.

Although supporters of the team claim that no initial investment was raised, and therefore there was technically no “rug pull” at all, the high level of concentration of tokens in the hands of the Pi Foundation stirs up concerns of manipulation.

Primary exchange platforms such as Binance and Coinbase have not listed Pi, citing concerns about transparency and centralization, which further undercuts price prospects.

Demand was also influenced by the exit of an anonymous whale who had amassed more than 383 million Pi coins. The fact that this whale has stopped purchasing has eliminated the essential support to the price of the token, further exerting downward pressure.