Funding rates on crypto derivatives hit 3-year lows and suggested a flipping of the market amidst massive liquidation and speculative reset.

The rates of crypto derivatives funding are now at their lowest since the 2022 bear market. This abrupt decline comes after the liquidation of billions of leveraged positions.

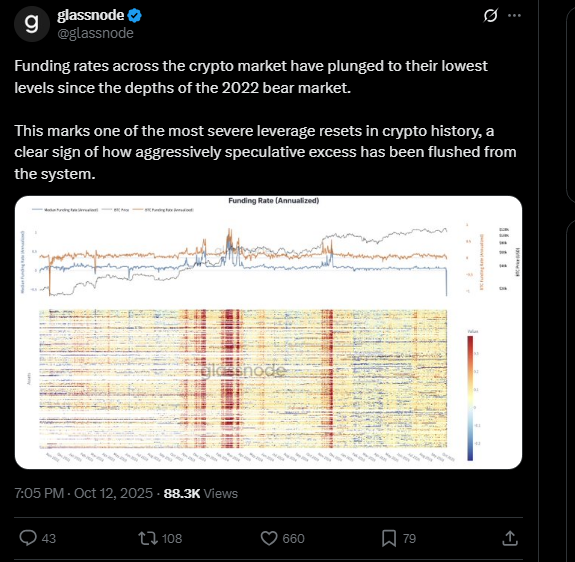

Glassnode, an on-chain analytics provider, reported the drastic collapse on Sunday and pointed out one of the most drastic leverage resets in the history of crypto.

Source- X

Funding rates are periodic payments exchanged by traders in popular crypto derivatives known as perpetual futures contracts.

These payments will bring the price in the contract and the underlying spot price into balance.

When the rates of funds are very low and even negative, it means that there are more short positions than long positions.

This is usually an indication that traders anticipate a decline in prices and are prepared to compensate to own these shorts.

More Shorts Than Ever – But Is It Bullish?

The current funding rate environment reflects an overselling case where there are too many short positions accumulating.

This may establish a powerful short squeeze as prices start to increase, with shorts forced to enter the market at a loss, driving the prices up.

CoinGlass data indicates that there is a shift in market sentiment. The majority of traders are bullish or very bullish (54 percent), followed by the bearish traders (29 percent) and the neutral traders (16 percent).

There is now a 60:40 ratio between long positions and short positions in open accounts.

In spite of these factors, the funding rates of Bitcoin and Ether perpetual swaps are slightly negative.

Nevertheless, spot markets have recorded good rebounds. Bitcoin rose by more than 5 per cent since it was below $110,000, and Ether rose by 12 per cent since its recent lows.

Historic Liquidations Trigger Market Reset

This drop in funding rates is after what some term crypto black Friday, a historic liquidation.

About one trillion dollars of market capitalization fell by 25 percent within hours. Leveraged long holders were pushed out, and 1.6 million accounts were liquidated.

The first time in history red candlestick of Bitcoin resulted in the loss of 380 billion market cap, and after that, a V-shaped recovery followed as short positions were shut down.

It is a huge deleveraging and speculative flush that is necessary to stabilize the market following an over-specification of derivatives.

It reestablishes leverage by liquidating overextended traders, facilitating more balanced market dynamics.