Strategy remains stable after the Bitcoin dip. Analysts say its S&P 500 inclusion prospects are still on track despite the correction.

Strategy drew fresh attention after the recent Bitcoin selloff. The drop raised doubts about companies that hold large amounts of Bitcoin on their balance sheets.

Strategy faces these questions often, yet analysts say the company still looks steady. They also believe its S&P 500 bid remains on track.

Strategy performance stands out despite the sharp correction

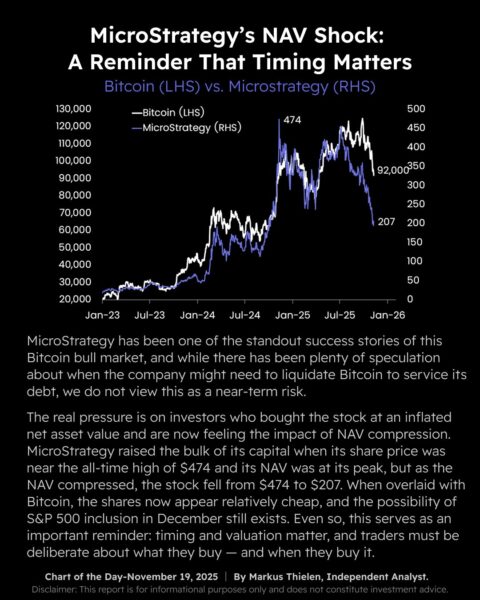

Strategy saw its share price fall from a high of $474 to around $207. The drop followed the wider crypto market slide and despite the move, Matrixport researchers said the company still stands on firm ground.

They see no sign that Strategy will face forced selling or major stress from the downturn.

Analysts at Matrixport said the recent pressure sits mainly on shareholders who bought the stock at a premium. That premium faded once Bitcoin moved lower. This caused a steep compression in net asset value.

The company, however, did not show signs of distress.

Crypto research group 10X Research reported a 70% chance that Strategy will join the S&P 500 before the year ends. Their assessment supports Matrixport’s view that the correction did not weaken the company’s long-term outlook.

Strategy stock, and S&P 500 inclusion hopes

Strategy now appears cheap when compared with Bitcoin’s price trend. Matrixport analysts said the stock trades at a level that does not reflect the company’s current balance sheet strength.

They also wrote that the S&P 500 inclusion remains possible in December.

S&P Global Ratings issued a B minus rating for Strategy.

The grade sits in speculative territory, but it marks the first rating of its kind for a Bitcoin treasury company. Analysts said the rating gives the market a new point of comparison when assessing similar firms.

The rating does not affect index inclusion on its own. The main drivers will be market value, liquidity, and listing rules. Strategy still meets these criteria. The December window remains open.

Smaller corporate crypto treasuries face tighter conditions

Other firms did not hold up as well. Several smaller companies with digital asset treasuries faced more intense pressure.

Their mNAV ratios slipped below 1, which restricts their ability to raise funds by issuing new shares. For context, mNAV compares enterprise value to the value of crypto holdings. A ratio above 1 lets a company raise capital, and a ratio below 1 reduces that flexibility.

Treasury companies that moved below this threshold include BitMine, Metaplanet, Sharplink Gaming, Upexi and DeFi Development Corp. Standard Chartered data shows that mNAV weakness started building months ago and spread across many firms.

Related Reading: Is Strategy Selling Bitcoin? Saylor Denies The Rumors

Strategy leadership maintains confidence during the downturn

Michael Saylor, the executive chairman of Strategy, addressed concerns during a Fox Business interview.

He said the company was built to survive major declines in Bitcoin’s price. He added that Strategy could handle an 80 to 90% drawdown.

Saylor also pointed to the company’s latest purchase. Strategy acquired 8,178 Bitcoin worth $835 million. This figure stands far above its recent average of roughly 400 to 500 BTC bought each month. The move shows that the company has not slowed its accumulation.

These actions support the view that Strategy is still committed to its long-term plan. The company still holds the largest corporate Bitcoin treasury in the world and the recent purchase only strengthens its position further.