Whales sold over 500 million DOGE this week, which suggests that the market sentiment has changed, and the future of Dogecoin and its stability remains doubtful.

A total of 500 million DOGE coins were dumped by dogecoin whales in the last week, and this is a huge sell-off event, which is indicative of a change in the confidence of the market and the behaviour of investors.

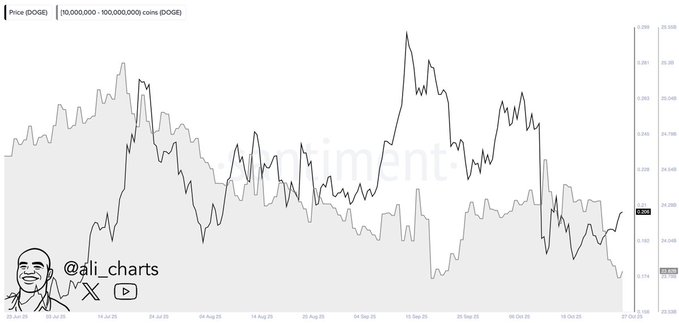

On-chain information provided by a financial analyst, Ali Martinez, on X, based on Santiment metrics, shows wallets in the 10 million-100 million DOGE range reducing their balance sharply in late October.

Source – X

Whale Sell-Off Drives Market Concerns

The consistent decline in DOGE held by whales is consistent with stagnant price movement in the range of $0.206 that occurred after weeks of fluctuation between $0.19 $0.26.

The big holders, who are commonly regarded as the smart money, seem to be making profits even when the situation is uncertain.

Such an activity indicates that there is a possibility that the whales are about to face additional market cooling or further periods of consolidation.

The rate of sell-off is quite high compared to the average weekly trade in whales in previous years in 2025, indicating a significant shift in their trading behavior.

The large holders who trade such volumes tend to tone the price in the short run. The present decline is associated with a decline in the open interest of the futures by 61 percent, signifying fatigue by traders and liquidations.

These sell-offs did not cause the trading volume to reduce, but on the contrary, the volume went up by 17.5, showing that there are still strong selling pressures within the market.

Historical Perspectives on Whale Patterns

Previous cycles indicate that there is a history of such whale sell-offs, which have been followed by temporary price pullbacks and a phase of accumulation by smaller investors.

Similar whale actions deflected DOGE prices between July and September 2025 and then steadier recoveries.

The scale of the present sell-off, however, of more than 500 million DOGE in seven days, indicates a massive de-risking of large holders, indicating some nervousness in the face of wider macroeconomic heat.

Whale actions are typically associated with general rotation patterns, in which the movement of capital off altcoins in favor of existing coins, such as Bitcoin and Ethereum, occurs.

The upward or downward recovery of DOGE might be determined by the reaction of retail investors and the possible re-entrance of whales.

Market Watch: Can Dogecoin Hold Support?

The Dogecoin price is held under a serious psychological support point of 0.20. Any further decline of this value will run the risk of pushing the prices even lower to the $0.17-0.18 price range, which has been traditionally entered by buyers.

But when DOGE is priced above $0.20, the present whale action may be just a repositioning effect as opposed to an entire market exit.

It is unclear how the sell-off would affect the market stability of Dogecoin. The community backing and integrations of the ecosystem of the token have the capacity to cushion against long-term declines until the whales and retail investors begin to shift their moves.declines until the whales and retail investors begin to shift their moves.