Crypto ETF options caps face review as Bitcoin and Ether contracts show strong growth in volume and open interest.

Nasdaq has asked regulators to reconsider position limits on Bitcoin ETF options as trading activity continues to expand. As per recent data. These BTC tied investment vehicles are showing steady growth in volume and open interest across listed contracts. Despite rising demand, strict caps still limit the exposure traders can hold. Nasdaq argues these limits now block participation across crypto-linked options markets.

Push for Higher Limits on Bitcoin and Ether ETFs Options

A filing dated January 21 outlines Nasdaq’s proposal to amend its options position and exercise limit rules. Current rules impose a 25,000 contract cap on options tied to crypto exchange-traded funds.

According to Nasdaq, current rules discourage liquidity providers and large institutions from trading Bitcoin ETF options at scale. Reduced participation weakens liquidity and limits efficient pricing across options markets. Fewer active players also restrict the ability to absorb sharp price moves during volatile periods.

Nasdaq wants those limits removed so crypto ETF options follow the same rules as other ETF options. Affected products include Bitcoin and Ethereum ETFs issued by BlackRock, Fidelity, Grayscale, Bitwise, ARK twenty-one Shares, and VanEck.

The firm argued existing restrictions no longer reflect market depth, liquidity, or participation seen since spot ETF launches. Nasdaq also requested that regulators waive a standard 30-day waiting period for rule changes.

Immediate effectiveness would allow updated limits to apply while the public comment process continues. The SEC retains the authority to suspend the change for up to 60 days if further review is required. A final regulatory decision is expected by late February.

IBIT Options Rank Among Top U.S. Assets by Open Interest

Options tied to BlackRock’s iShares Bitcoin ETF have seen rapid growth in trading activity. Data from Sosovalue shows IBIT options rank eleventh among U.S. assets by total open interest. More than 5.3 million contracts remain open, though activity still trails that of gold and silver ETF options.

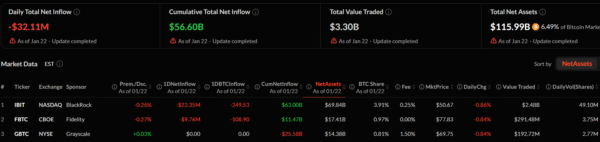

Moreover, Spot Bitcoin ETFs have recorded heavy outflows during recent trading sessions. According to SosoValue, total withdrawals reached $32.11 million yesterday, marking 4 consecutive days of outflows. BlackRock led redemptions with $22.35 million, followed by Fidelity at $9.76 million.

Image Source: SosoValue

Risk management remains another focus of the proposal. Notably, options allow investors to hedge downside exposure while maintaining long positions in underlying assets. Broader access to Bitcoin ETF options could reduce panic selling during periods of stress.

Uniform Limits May Open Door to Broader Ether ETF Options Trading

Attention in recent filings extends to Ether ETF options as demand for Ethereum exposure continues to rise. Interest picked up after the approval of spot Ether ETFs, prompting traders to seek better ways to manage risks tied to protocol upgrades and ecosystem changes.

At the same time, Ether-linked options often carry higher volatility than Bitcoin products. As such, experienced derivatives traders often use larger positions to handle price swings. Higher position limits could improve liquidity and support more accurate execution of advanced strategies.

In addition, Nasdaq proposes uniform position limits across major crypto ETFs, a step that could ease compliance and attract broader participation. Bitcoin trades near $88,893 with modest daily gains, while Ether sits around $2,921 after a weekly drop, keeping demand for options strong.

Image from Nasdaq.