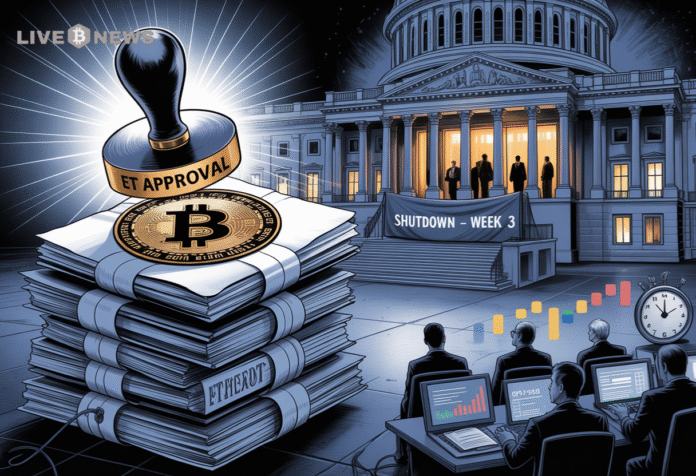

US government shutdown enters week three, delaying SEC approval of 16 crypto ETFs and adding uncertainty to digital markets.

The US government shutdown has now stretched into its third week, after freezing progress on 16 pending crypto ETF applications.

The SEC was expected to rule on a wave of ETF filings this month, including funds tied to Bitcoin, Solana, XRP and Litecoin. Another 21 applications were submitted in the first week of October alone.

Those reviews are now stalled until lawmakers reach an agreement to restore government funding.

Crypto ETF Approvals Frozen by Political Stalemate

The shutdown started when Republicans and Democrats failed to agree on spending laws. Federal agencies, including the SEC, were forced to halt most operations.

The disagreement is related to how to address the nation’s ballooning debt, which has reached $37.8 trillion.

Republicans are demanding lower spending and higher allocations for border enforcement. Democrats on the other hand, oppose cuts to healthcare and want to extend tax credits.

Neither side has shown signs of compromise, which has left the shutdown without an end date.

The Senate is not scheduled to vote until Tuesday, while the House of Representatives remains out of session.

To reopen the government, Congress must pass funding bills or a temporary continuing resolution. President Donald Trump would then sign the measures into law.

Analysts Expect ETF ‘Floodgates’ to Open After Shutdown

ETF analysts believe that once the government resumes operations, the SEC will move quickly to clear the backlog. Nate Geraci, president of NovaDius Wealth Management, said the end of the shutdown could unleash “spot crypto ETF floodgates.”

Once government shutdown ends, spot crypto ETF floodgates open…

Ironic that growing fiscal debt & usual political theater holding these up.

Exactly what crypto is targeting.

— Nate Geraci (@NateGeraci) October 13, 2025

Bitfinex analysts have predicted that once approvals resume, the market could experience an “altcoin season.”

This would see strong demand for alternative cryptocurrencies like Solana, Litecoin and Dogecoin.

ETF Delays Highlight Crypto’s Dependence on Regulation

Even though crypto was created to work independently of centralised control, the shutdown shows how reliant the industry still is on traditional institutions.

Without the SEC’s approval, new financial products cannot launch and investor confidence hangs in limbo.

Eric Balchunas, senior ETF analyst at Bloomberg, compared the delay to “a rain delay.” He said approvals will eventually move forward, but the interruption could affect things like trading and investor sentiment.

Political Uncertainty Clouds the Path Ahead

The government deadlock has not only frozen ETF approvals but also shaken market confidence. Historical data shows that extended shutdowns tend to increase the market’s volatility.

While the crypto market has been relatively stable so far, traders are still on their toes. Many expect that as soon as the shutdown ends, the SEC will approve multiple ETFs at once.

Altcoin Season Awaits the SEC’s Next Move

Bitfinex analysts say that once ETFs launch, capital could spread across several assets. Altcoins like Solana, XRP and Dogecoin may benefit most, considering their presence in pending ETF proposals.

The market could see new inflows from retail investors who prefer traditional investment products. These ETFs could also attract institutions that want regulated exposure without having to manage crypto wallets.

Nate Geraci believes that ETF approvals could be the “next major chapter” for the crypto market. He said that the temporary delay might only strengthen the industry once the freeze lifts.