The liquidation of Ethereum features a massive market reset through the leverage flush of the asset. The buys are aggressive and the interest purge is open, indicating a possible monster rebirth.

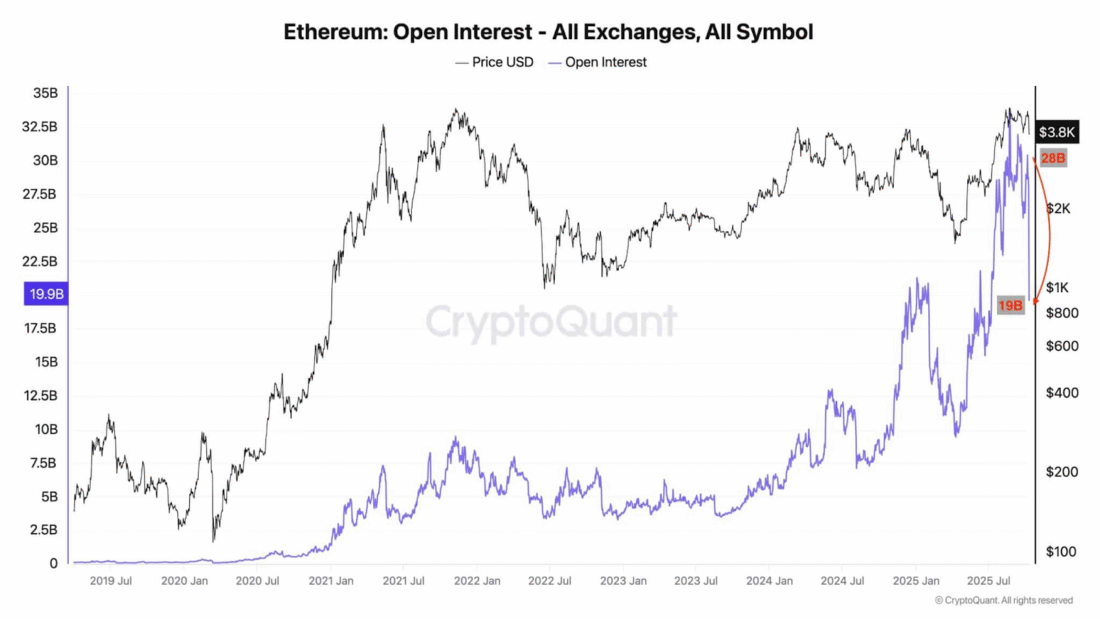

Ethereum has recently experienced the biggest purge in open interest in its history, losing more than $28 billion to $19 billion in just 24 hours.

Source: CryptoQuant

This deleveraging plan of clearing off the excess leverage at a higher rate than normal re-established the market environment. In records, when Ethereum sells off more than Bitcoin does, it usually bounces back better.

Ethereum dropped 18 percent and Bitcoin dropped 7 percent between mid-September. Two weeks after that, ETH rose 14 percent, compared to 10 percent in Bitcoin.

Such a trend is directly associated with the fluctuations in the derivatives market, where Ethereum has a larger leverage, which leads to more intense movements.

Aggressive Whale Accumulation Cuts Through Market Fear

BitMine (BMNR), which is a major whale, was the biggest buyer in this time frame, purchasing more than 128,000 ETH worth approximately 480 million at the latest dip.

Their mean cost base is about $3,730, which justifies purchases of a buying opportunity during the shakeout.

The conviction of BMNR serves as an indicator, pushing against fear and uncertainty (FUD) and stimulating the fear of missing out (FOMO).

This activity in the whale is an indicator of the possible point of inflection where investors can expect a trend reversal.

Ethereum answered with an intraday increase of 2.27 percent, and regained ground and made a greater show against Bitcoin.

The $10B Open Interest Purge: A Healthy Market Shakeout

Record open interest wipeout. On October 10, the derivatives market of Ethereum wiped around 10 billion dollars in positions in one day, a considerably unusual deleverage event.

This is seen as a long-overdue reset by analysts, and this has opened the way to smart money coming in at discounted levels.

Geopolitical tensions were also present at the time of the purge, contributing to the volatility of leveraged positions on Ethereum and other large cryptocurrencies.

In spite of the purge, the market took the shock, and Ethereum was resilient again, providing an opportunity for a strong recovery.

Ethereum’s Leverage Dynamics Make It Prone to Volatility

The very high leverage futures market increases the effects of price actions in Ethereum. Fluctuations in open interest become the direct causes of price volatility and tend to lead to more severe drawdowns and rallies.

This puts Ethereum in a special position of quick rebounds following massive flushes. The ETH/BTC ratio is seen to improve throughout the day, a good indication that Ethereum can beat Bitcoin in a future recovery.

The derivatives rollover and whale buying would provide a boost in demand and price action in the short term.