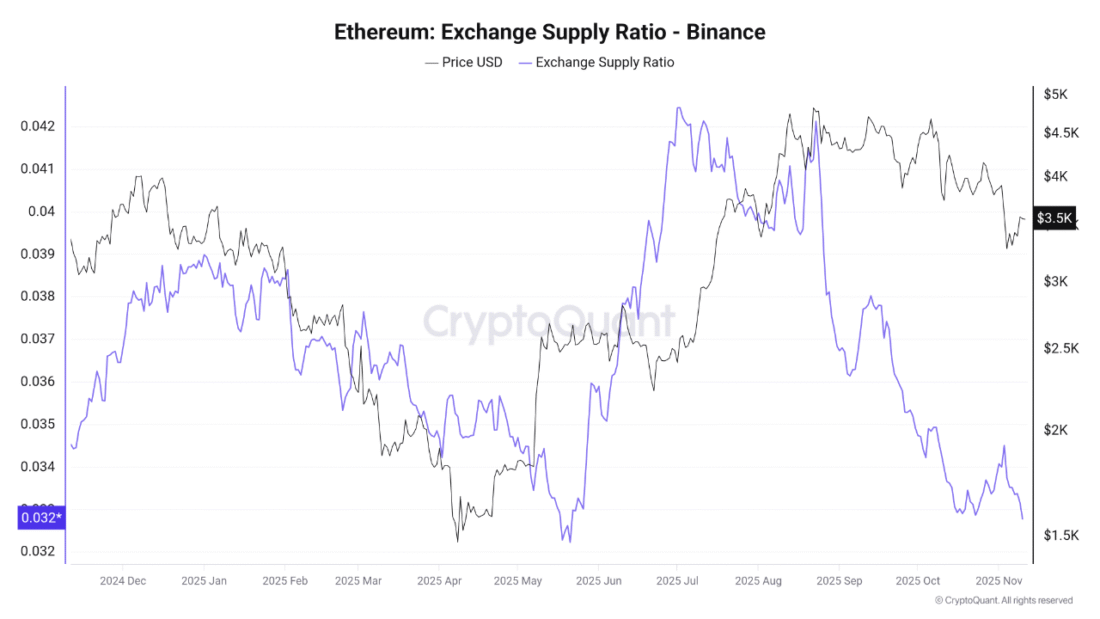

The Ethereum supply on exchanges is at the lowest point in one year as the whales continue accumulating in large amounts, triggering the bullish investor sentiment and indicating a future increase in prices.

The number of Ether holdings at large exchanges has decreased significantly to the lowest point since May 2024, indicating a major shift in investor behavior and market dynamics.

Cryptocurrency analytics on CryptoQuant and Binance indicate that a consistent supply of Ethereum (ETH) is leaving centralized exchanges and, more specifically, Binance, the biggest Ethereum trading site by volume.

Source – cryptoquant.com/

This pattern relates to traders moving their holdings in private or cold wallets, which can be a positive trend that signifies long-term purchase and a lack of selling pressure.

Although the price of Ethereum experienced a downward momentum after reaching its highest point of 4,500 and even 5,000 in mid-2025, the decrease in supply on the exchanges showed that most investors are not selling their ETH, but instead are holding on to them in hopes that they can sell them at a later date.

Massive Whale Accumulation Fuels Market Optimism

Whales who own 10,000 to 100,000 ETH have also grown their wallets by about 7.6 million ETH since April 2025, which is a 52 percent increase.

This buildup goes against the retail investors, who have reduced their exposure, and this is an indication of diverging confidence levels among the types of investors.

Institutional investors and deep-pocket individuals have evidently been aggressively positioning themselves in Ethereum, indicating a high conviction in its potential in the long term.

One of such major stakeholders is BitMine Immersion Technologies, which has recently purchased more than 110,000 ETH, which includes its total holdings of approximately 3.5 million ETH, worth approximately 12.5 billion.

BitMine is targeting to own 5 percent of the overall supply of Ethereum, which highlights increasing institutional investment.

The chairman of BitMine pointed out that this continued interest is being generated by the better fundamentals of Ethereum and the upcoming upgrades of the network.

Upgrades and Market Dynamics Underpin Bullish Signals

The next upgrade of Ethereum, Fusaka, will be launched in December 2025 and should bring some scalability and efficiency.

This technical development makes Ethereum better as a base blockchain for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs).

The lower supply in the exchanges, combined with the institutional stock, is largely seen as a stage to be stabilized in price and a new bullish run when the momentum of the market again picks up.