Ethereum’s link to U.S. small-cap stocks, rising ETF inflows, and a bullish setup hint at a potential breakout as rate cuts near.

Ethereum’s correlation with US small-cap stocks has caught the attention of analysts.

This alignment was described as “almost spooky” by analysts at Milk Road, indicating that the cryptocurrency may be poised for a significant move.

As the Federal Reserve prepares for rate cuts, both Ethereum and small-cap stocks could rise together.

Ethereum Correlation With Small-Cap Stocks

Analysts at macro investor outlet Milk Road pointed out how Ethereum’s price is similar to the Russell 2000 Index.

This correlation is almost spooky.

The Russell 2000 (small cap equities) and $ETH are basically moving in sync.

Both are highly sensitive to interest rates.

With 4+ consecutive cuts on the horizon…

Expect both of them to move up in tandem. pic.twitter.com/V6HLlZpPht

— Milk Road Macro (@MilkRoadMacro) October 7, 2025

The index tracks 2,000 U.S. companies with small market caps and is often seen as a gauge of economic health. Both Ethereum and these small-cap stocks are highly sensitive to interest rate changes.

CME futures data shows a 95.7% chance of a 0.25% Federal Reserve rate cut at its October 29 meeting. There is also an 82.2% probability of another cut in December. If the cuts proceed as expected, investors believe both assets could climb together.

Justin d’Anethan, head of partnerships at Arctic Digital, noted that, unlike Bitcoin, Ethereum generates yield. This yield becomes more attractive when interest rates fall as investors look for income-producing assets.

Technical Patterns Show Strength

Ethereum’s price chart is forming a classic cup-and-handle pattern. This pattern tends to point towards consolidation before a new upward move. Analysts believe this structure could pave the way for a rally toward $7,500 by the end of the year.

Chart specialist Matt Hughes pointed out that Ethereum has been holding above the $4,350 support level. If this level remains firm, he expects new all-time highs. Other analysts have indicated possible targets of $5,200 in the near term and even $8,500 later in the cycle.

$ETH looks primed to break into all-time high territory, as it's finally finding stability above the $4,350s. As long as that zone continues to hold as support, ATHs aren't too far away.

5200 is my next target above 🚀#ETH pic.twitter.com/W75iSp4Upj

— The Great Mattsby (@matthughes13) October 7, 2025

Historically, when Ethereum’s Relative Strength Index (RSI) reached oversold levels, the asset rebounded sharply. In past cycles, this setup led to price gains of more than 100% within a few months.

Institutional Demand Continues to Grow

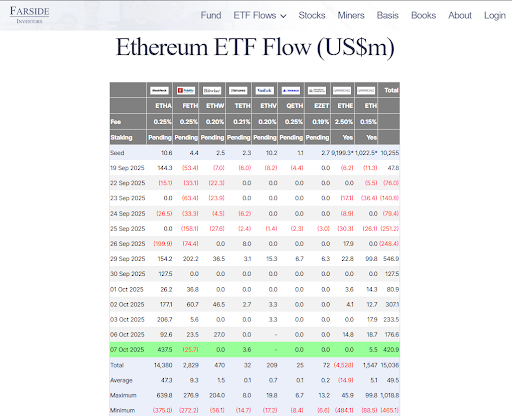

One of the biggest drivers of Ethereum’s ongoing strength is the rising level of institutional participation. Over the past week, Ethereum ETFs recorded $1.3 billion in new inflows.

BlackRock alone accounted for $691.7 million of this figure.

This surge is in line with the rotation of capital from Bitcoin to Ethereum. Ethereum’s market share has climbed from 9.79% to 11.85% since July. Meanwhile, Bitcoin’s dominance has slipped from 66% to 61.8%.

Analysts are linking this trend to Ethereum’s use case as a productive asset through staking and defi. Staking volumes have now reached 35.5 million ETH, while more than 1 million ETH has been withdrawn from centralised exchanges.

Upcoming Fusaka Upgrade Boosts Scalability

Ethereum’s developers are preparing the Fusaka upgrade for December. The upgrade will improve scalability by increasing blob capacity and lowering Layer 2 transaction costs.

These changes are expected to improve the network’s efficiency and make it more competitive for Dapps. Some analysts believe the upgrade could help Ethereum grow independently of Bitcoin’s price cycles by strengthening it as the main platform for defi and other use cases.