Ethereum exchange outflows reach 200K ETH, while traders watch $4.1K–$4.2K support for potential rebound.

Ethereum has seen $1 billion worth of tokens leave exchanges within two days, sparking renewed attention from traders and institutions. This movement suggests that investors are shifting towards holding rather than selling, at a time when analysts point to a potential accumulation zone around $4,100 to $4,200.

Exchange Outflows Strengthen Bullish Case

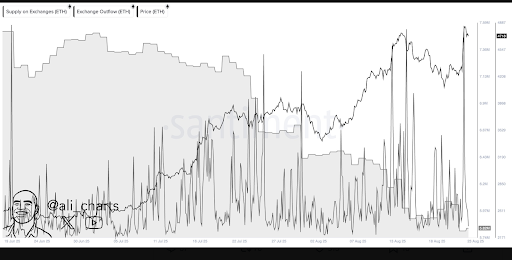

Ali Charts reported that 200,000 ETH were withdrawn from exchanges within a 48-hour period. At current prices near $4,800, this represents close to $1 billion worth of assets. Such large-scale outflows reduce available liquidity on centralized platforms and tend to lower immediate selling pressure.

Data also shows that more than 1 million ETH left exchanges in the past month. The pattern has been observed across both retail and institutional investors, with increasing preference for long-term storage and staking. Analysts note that sustained withdrawals may create a supply squeeze, which supports the token’s price stability during market corrections.

Ethereum’s exchange activity comes after a sharp rebound from its early-year low of $1,400. The token has since surged past $4,800, setting a new all-time high last week. Market participants now watch closely for signs of consolidation before another move higher.

Analysts Point to Key Ethereum Price Levels

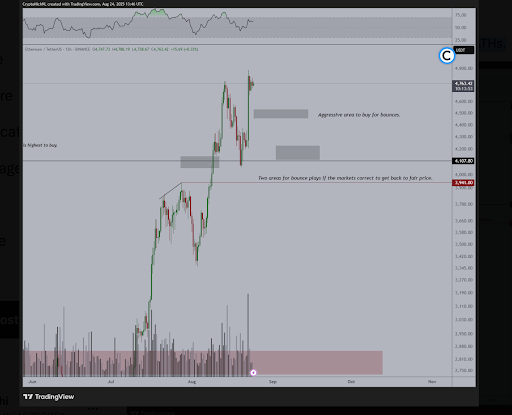

Michael van de Poppe suggested that if Ethereum corrects further, the asset could find support around the $4,100 to $4,200 range. This level is now seen as a key accumulation area for traders who expect Ethereum to target new highs in the future.

Technical indicators show a mixed picture. Ethereum trades above major moving averages, which supports a positive outlook. However, the relative strength index remains near overbought territory, signaling a possible cooling period. If ETH dips further, additional support zones are expected near $3,680 and $3,480, while resistance remains at $3,960 and $4,200.

Recent data from CoinGlass shows that spot trading volumes declined slightly, while futures activity increased more than 28 percent. This indicates that leveraged traders continue to anticipate larger moves, despite short-term pullbacks.

ETF Inflows and Market Outlook

Institutional demand remains steady, with Ethereum ETFs recording inflows of over $5 billion in July. On July 28 alone, more than $65 million entered the market through ETF products. The steady inflows provide an additional layer of support and reduce the effect of short-term volatility.

More than 1 million Ethereum $ETH have been withdrawn from crypto exchanges in the past month! pic.twitter.com/rP18ToPz7V

— Ali (@ali_charts) July 28, 2025

Ethereum also filled a weekly CME futures gap during its latest correction, which many traders had expected before the rally could continue. Analysts such as Rekt Capital observed that the gap was completed before the token reversed upward.

Market participants are also watching the ETH/BTC pair, which has shown strength in recent sessions. Analysts suggest that Ethereum’s performance relative to Bitcoin may set the tone for a broader altcoin rally, often described as altseason. With exchange withdrawals rising and institutional flows steady, Ethereum remains positioned near a crucial price zone.