Bitcoin short-term holders ease profit-taking at $115K as analysts note balanced market despite ETF outflows and lower leverage.

Bitcoin short-term holders have slowed their profit-taking as the price stabilises near $115,000.

According to Glassnode, the Bitcoin market is now in a “relatively balanced position,” despite recent pullbacks from all-time highs.

This cooling off by short-term holders indicates that caution is rising, but analysts say it’s typical behaviour during mid-cycle corrections.

Short-Term Holders are Important for Bitcoin Volatility

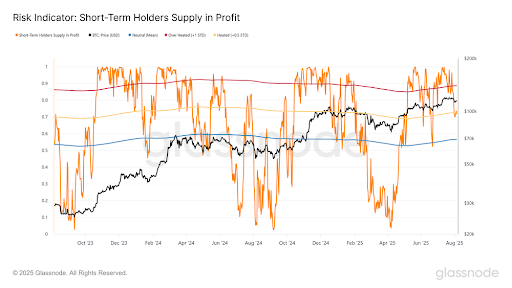

Short-term holders (STHs) are traders or investors who have held their Bitcoin for less than 155 days. Historically, they are more reactive when prices become volatile.

Glassnode’s latest report shows that just 45% of Bitcoin spent by these short-term holders recently was in profit. This is a long way down from higher levels earlier this year and below the neutral mark of 50%.

“The market is in a relatively balanced position,” Glassnode noted, pointing out that around 70% of STH-held supply is still in profit.

This data indicates that the market is steady, where fear hasn’t overtaken sentiment, but traders are increasingly becoming cautious.

The fact that 30% of short-term holders are in loss also shows the pressure felt by recent buyers, especially those who bought near July’s all-time highs.

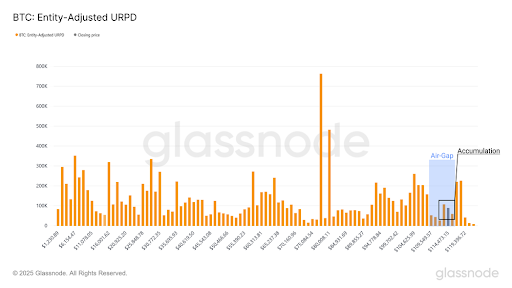

Market Faces “Air-Gap” Resistance Below $116K

Bitcoin’s price dropped to $112,000 at the end of July, after peaking at $123,000 mid-month. That decline pushed it into a thinly traded “air-gap” zone under $116,000, which is an area with little historical trading activity.

This zone now acts as near-term resistance. Short-term holders with an average cost basis of around $116,900 are under pressure and many are selling near break-even.

“Many recent top buyers and weaker hands are saying ‘get me out,’” analyst Checkonchain noted on social media.

Analysts continue to warn that if the market continues to trade below $116,000 for long, losses could deepen for STHs and erode overall confidence.

In sum, a drop toward $110,000 is still a possibility if this zone holds as resistance.

Leverage Drops as Traders Wait for Direction

Another major factor in Bitcoin’s ongoing price action is the clear drop in leveraged positions. Funding rates on perpetual futures have fallen below 0.10%, which indicates that traders are less willing to bet on higher prices using borrowed money.

This kind of signal shows a wait-and-see approach from investors, and Glassnode called the structure “normal for a bull-market correction.”

However, it added that a deeper weakness could turn the tide bearish.

Meanwhile, the Bitcoin spot ETFs recently recorded their largest outflow since April. On August 5, funds saw a net withdrawal of 1,500 BTC. That has briefly shaken confidence, even though the very next day saw $91.5 million in inflows.

Despite the current indecision, some analysts are still optimistic, like Tom Lee, co-founder of Fundstrat and chairman of BitMine.

Lee recently said that Bitcoin could hit $200,000 or even $250,000 before the end of the year.

“Bitcoin should really build upon this $120K level,” Lee said.