HBAR price is giving bullish signals of a breakout because the Hedera network and volume of transactions are increasing, backed by Elliott Wave and technical formations.

HBAR, the native token of Hedera, is exhibiting strong bullish indicators as the network activity and transaction volumes increase.

Recent technical analysis indicates that the technical setup shows an increasing triangle and Elliott Wave holding that may break through the price between 0.21 and a high of 0.45.

This is an increase in trading interest and network utility as the decentralized applications and tokenization projects of Hedera are increasingly being adopted in 2025.

Rising Transaction Volume Sparks Price Momentum

HBAR/USDT charts depict consolidation in the form of an upward triangle with an increase in lows under horizontal resistance. This technical structure is a classic technical formation that usually leads to powerful positive developments.

The analysts have noted that there are main structures in waves that may give a breakout that could potentially push the prices further down to $0.21-0.22 in the short run.

The growth of volume indicators depicts rising trade participation at the support levels, which legitimize the growing market interest and accumulation stages.

A crypto trader on X, PascalTrades, pointed to a Primary 3 setup with a target price of about $0.45, indicating further bullish action was critical support between $0.185 and $0.195 to be made.

Source: Pascal Trades Via X

The positive expectation is supported by Hedera network metrics. Hedera volumes of transactions have shot up continuously, with growing adoption in various applications like decentralized finance (DeFi), payment, and enterprise.

Daily transactions are in the hundreds of thousands, and in a few cases, it has peaked at over 100 million, far surpassing some of its competitors.

This increased trading not only indicates high token utility but also provides groundwork for investor confidence in the long term.

DeFi Engagement and Liquidity Stabilization

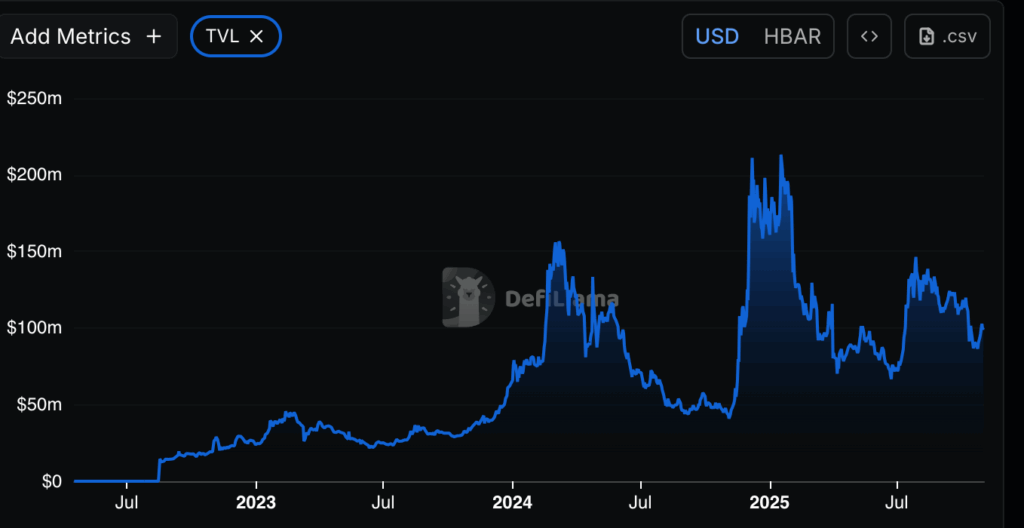

Hedera-based DeFi projects’ value locked in has been becoming more stable in 2025, with a range of between 50 million and 150 million.

Source: Defillama

Such a dynamic indicates the ongoing investor engagement in spite of the changes in the market, which highlights stable ecosystem interaction.

These liquidity amounts favor the technical and fundamental performances of HBAR prices.

The combination of optimistic technical projections, such as Elliott Wave effects, an upward triangle, and an increase in the volume of transactions creates an attractive scene.

Investors and traders following HBAR could expect a breakout period that has short-term profits of about $0.22 and medium-term spikes of about $0.45.