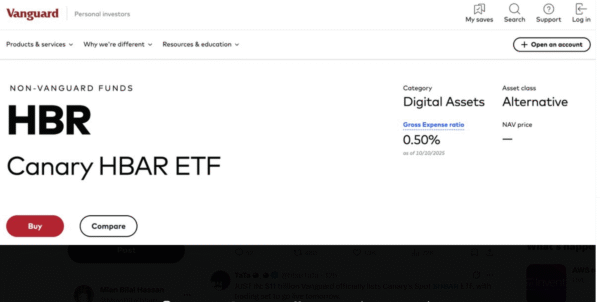

Vanguard lists the first HBAR ETF, giving global investors regulated Hedera exposure while expanding access to crypto-linked products through traditional platforms.

Vanguard is offering access to an HBAR ETF that delivers simple Hedera exposure through regulated channels. Although Canary Capital initiated the product, it’s now on the list of products Vanguard offers on its platform. This shift provides an accessible route for global investors to Hedera without the need for crypto exchanges. Moreover, it represents an increasing level of interest by traditional market participants in regulated digital-asset instruments.

Vanguard Expands Access to Crypto Exposure

Vanguard recently reversed its long resistance to crypto products and made it possible to trade in approved digital asset ETFs and mutual funds. This update came on December 2, 2025, and added almost fifty million customers to the access. Furthermore, the policy change opened up new visibility to the third-party crypto offerings. Consequently, Canary Capital’s HBR ETF attracted renewed investor attention as a would-be regulated exposure to Hedera.

The HBR ETF started trading on Nasdaq in late October 2025, and it attracted early demand from retail users. It provides indirect exposure to Hedera without custody issues. Additionally, it promotes the diversification of a portfolio through compliant brokerage accounts. This structure has an appeal to investors who like to trade in regulated frameworks. As the number of adoptions increases, the ETF serves as a boost to Hedera’s presence on mainstream financial markets.

Related Reading: HBAR News: HBAR Rejoins Coinbase 50 Index After Early Removal | Live Bitcoin News

The network has enterprise use cases that demand stable performance. HBAR is the native token for fees and staking. Moreover, Hedera runs a decentralized public network that uses hashgraph consensus for fast settlement of transactions. These features help in long-term interests of the institutions. Because the ETF tracks the movements of HBAR, investors can track the activity of the network through simplified brokerage dashboards.

Growing Market Strain Shapes Investor Expectations

The current market situation is still difficult. HBAR is trading around $0.1339 and is under constant pressure on prices. According to analysts, the token is projected to stay near $0.132 in December 2025. Additionally, there is a potential dip to $0.1317 on the forecast. Although these movements are reflective of the general volatility, some observers look forward to renewed stability as regulated funds bring better liquidity into several digital-asset markets.

Experts point out that HBAR has fallen by fifty-seven percent from its peak in 2025. This decline is in line with general corrections in leading assets. In addition, heavy selling was followed by uncertainty in global markets. Even so, analysts find that greater accessibility of ETFs may help support more long-term demand. Consequently, they have a stabilizing effect when extended market stress is present by regulating exposure.

Canary Capital is continuing to add more products to its portfolio to capitalize on the growing demand for crypto-linked instruments. Its strategy is to lower the technical complexity for new purchasers. Additionally, the firm notes increased interest from the younger investors. As the demand goes up, more offerings that are region-specific are planned. This approach is for wider adoption while promoting traditional investors to compliant exposure to blockchain.

Overall, the addition of the HBR ETF to the Vanguard platform is a significant milestone. Investors now get exposed to Hedera exposure through regulated channels. In addition, this access may bolster confidence in times of volatility. As adoption increases, there is potential for improving liquidity in related markets. Ultimately, the development heralds the integration of digital assets within the traditional investment structures.