Fed rate cuts often lift markets, but history shows they can signal deeper economic troubles, a caution for crypto investors.

Talks of a potential Fed rate cut in September have been loud lately across the crypto and stock markets.

Many investors believe lower interest rates will pump new life into Bitcoin, altcoins and tech stocks. However, history shows that this optimism could be misplaced.

In fact, a Fed rate cut has often come right before a recession, not after it.

A Fed Rate Cut Might Show Trouble Ahead

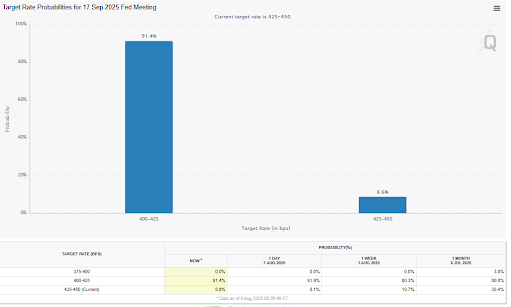

The chances of a Federal Reserve rate cut in September are now above 90% according to recent data from the CME Fed Watch tool. This is typically seen as bullish for the financial markets, because lower rates reduce the cost of borrowing and boost investment in high-risk assets like cryptocurrencies.

However, there is a catch. Major rate cuts in the past have usually arrived when the economy was already in decline.

Historically, rate cuts between 2001 and 2020 came just as the economy was falling into a recession. Despite investor optimism, these cuts weren’t good news. They were reactions to serious problems that were already happening.

This contradiction has led retail investors to question why recessions follow rate cuts if they’re meant to boost the economy.

The answer lies in timing and cuts happen AFTER the damage is done.

Is Crypto Set for a Temporary Boost?

Lower rates may bring a short-term surge in the crypto market. Investors might pour money into Bitcoin and altcoins as the hype creates a bullish wave. However, experts continue to warn that this should not be viewed as the start of a new bull run.

Henrik Zeberg, Head Macro Economist at Swissblock, believes we may be nearing the end of a cycle rather than the beginning of a new one.

According to a recent post on X, he compares the current tech and crypto rally to the final stages of the Dot-Com Bubble. AI hype, inflated valuations and investor euphoria could be the warning signs of a market peak, not a new normal.

Why Fed Rate Cuts Don’t Always Revive the Economy

When the Fed lowers interest rates, it makes borrowing cheaper. That sounds good, but it doesn’t always lead to higher spending or lending. If companies are uncertain or people are losing jobs, they may not borrow or spend, even if money is cheap.

Zeberg explained that declining labor data and consumer stress are already showing cracks in the economy. Swissblock predicted a recession late last year, and Zeberg believes that we’re now seeing the first signs.

Unemployment data will be important for the Fed’s decision-making. If job losses continue to rise, the Fed might be forced to act, not because they want to, but because the economy is already weakening.

Short-Term Highs, Long-Term Risk

As Bitcoin, the S&P 500, and tech stocks hit new highs, it’s tempting to think a rate cut will keep the rally going. However, this might be misleading.

Zeberg warned of a “melt-up”, where a rise in prices gets followed by a brutal collapse. Liquidity from lower interest rates could inflate prices so hard, that it sets the stage for a historic correction.

Fed Expected To Cut Interest Rates In September https://t.co/7CDutvWiOf pic.twitter.com/ZIBTn7zBUq

— Forbes (@Forbes) August 7, 2025

In essence if unemployment rises and inflation stays modest, a rate cut becomes more likely. But if inflation jumps again, the Fed may hold off, even if the economy is slowing.

So what should investors do?

For starters, crypto investors have two paths ahead of them. Should they chase the rally or prepare for a crash?

Experts generally advise against trying to time the market. While a Fed rate cut could offer a temporary bump, history indicates that caution is still advised.

Crypto and tech are highly sensitive to economic changes like these, and overconfidence has burned many traders in the past.

If you’re holding crypto for the long term, it may be wise to reduce exposure during times of market euphoria and prepare for volatility.

Market cycles don’t lie and if Zeberg and other analysts are right, we’re showing signs of being near the top.