Staying ahead of market trends is crucial in the rapidly growing world of cryptocurrency trading. Bitcoin, being the leading digital asset, often sets the tone for the entire crypto market. One of the most effective tools for monitoring Bitcoin’s market movements and spotting potential warning signs is the BTC heatmap. This visual tool allows traders and investors to quickly gauge market sentiment, performance, and volatility in real-time, providing insights that can inform better trading decisions.

Understanding the BTC Heatmap

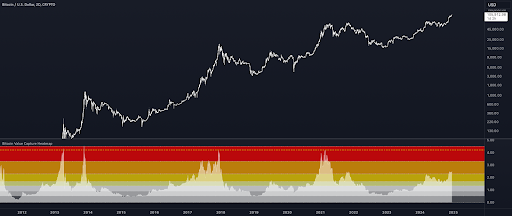

A BTC Heatmap is a dynamic, color-coded visual representation of Bitcoin’s price movements, market capitalization, and overall market activity. By using a combination of colors, sizes, and blocks, it highlights which assets are performing well and which are underperforming. Green blocks indicate upward price trends, while red blocks indicate declines. Larger blocks represent higher market capitalization, showing which assets dominate the market.

This visualization helps traders spot patterns quickly, making it easier to identify potential risks and opportunities. With real-time updates, the heatmap provides an accurate snapshot of market sentiment at any given moment.

Why Market Warning Signs Matter

Recognizing market warning signs is essential to minimize losses and protect investments. In the cryptocurrency market, prices can change dramatically within minutes. Warning signs can indicate potential downturns, high volatility, or sudden market shifts that may impact your portfolio. By identifying these signs early, traders can make informed decisions, such as adjusting their positions, diversifying assets, or setting stop-loss orders.

Key Warning Signs to Watch on a BTC Heatmap

1. Sudden Red Dominance

One of the first warning signs is a sudden increase in red blocks on the heatmap. This indicates that many cryptocurrencies, including Bitcoin, are experiencing price drops simultaneously. While occasional dips are normal, a rapid surge of red signals market-wide selling pressure, which could suggest an upcoming correction or increased volatility.

2. Sharp Changes in Block Size

Block sizes on a BTC Heatmap represent market capitalization. A sudden decrease in the size of Bitcoin’s block, or other major altcoins, may indicate a reduction in investor confidence or large-scale sell-offs. Observing these changes alongside price trends can alert traders to potential market shifts.

3. Unusual Trading Volume Patterns

High trading volumes, when combined with sharp price drops, often signal panic selling or market uncertainty. Conversely, low volume during price increases may indicate weak momentum. Monitoring these patterns on the heatmap allows traders to gauge whether market movements are sustainable or temporary spikes.

4. Sector-Wide Trends

Sometimes, specific sectors within the cryptocurrency market, such as DeFi coins or layer-2 solutions, may show extreme volatility. A BTC Heatmap allows you to isolate sectors and observe trends. If an entire sector is showing declining performance while Bitcoin remains stable, it could hint at potential risks in those niche areas.

How to Interpret These Warning Signs Effectively

Combine Heatmap Insights with Technical Analysis

While a BTC Heatmap provides visual cues, combining these observations with traditional technical analysis enhances their reliability. For example, if the heatmap shows a sudden red dominance and technical indicators signal overbought conditions, it strengthens the warning of a potential market correction.

Track Historical Patterns

Heatmaps also allow traders to study historical performance. By observing how similar patterns unfolded in the past, you can anticipate possible market behavior. This helps in forming a strategic plan and preparing for potential risks.

Monitor Real-Time Updates

Cryptocurrency markets are highly volatile. Continuous monitoring of the heatmap ensures that you are aware of sudden shifts. Real-time updates provide immediate insights, allowing for prompt decision-making.

Tips for Using a BTC Heatmap to Stay Safe

- Set Alerts: Many platforms allow you to set alerts for significant price changes or market shifts. This ensures you are notified when a warning sign appears.

- Diversify Your Portfolio: Avoid putting all investments in a single asset. Use insights from the heatmap to identify safer allocation strategies.

- Use Stop-Loss Orders: In volatile conditions, stop-loss orders help protect your investments from sudden downturns.

- Focus on Major Coins: While altcoins can be profitable, major cryptocurrencies like Bitcoin and Ethereum often indicate broader market trends. Pay attention to their performance blocks.

- Combine with Market News: External events can trigger market volatility. Cross-reference heatmap patterns with crypto news for a complete view of potential risks.

Common Mistakes to Avoid

Even with a powerful tool like a BTC Heatmap, traders can make mistakes. Avoid relying solely on color patterns without analyzing the underlying data. Don’t panic during minor fluctuations; small red blocks do not always signify a major downturn. Similarly, overconfidence in green dominance can lead to risky decisions. Combining heatmap insights with fundamental and technical analysis is key to making informed choices.

Practical Scenarios of Warning Signs

● Scenario 1: A sudden surge of red blocks across all major cryptocurrencies during market hours. Traders might interpret this as a sell-off signal and consider liquidating positions.

● Scenario 2: Bitcoin’s block shrinks noticeably while altcoins remain volatile. This could indicate a shift in market dominance and a potential risk for smaller investors.

● Scenario 3: Certain sectors like DeFi tokens show red dominance while Bitcoin remains green. This warns traders of sector-specific risk rather than a market-wide downturn.

By analyzing such scenarios, traders can plan their entries and exits strategically, reducing exposure to unexpected losses.

Conclusion

A BTC heatmap is an essential tool for identifying market warning signs in the cryptocurrency space. By observing color patterns, block sizes, trading volumes, and sector trends, traders can anticipate potential risks and make informed decisions. Combined with technical analysis and market news, it becomes an indispensable resource for both beginners and experienced investors. For access to real-time BTC heatmaps, detailed insights, and advanced tools for monitoring cryptocurrencies, TradingView provides a comprehensive platform to stay ahead in the fast-moving crypto market.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release