Arthur Hayes predicts Hyperliquid’s HYPE token could surge 126x by 2028, fueling optimism across the DeFi market.

Arthur Hayes, co-founder of BitMEX, has predicted that Hyperliquid’s HYPE token could rise 126 times by 2028. His statement at the WebX 2025 conference in Tokyo triggered fresh interest in the token and lifted its price. Within 24 hours, HYPE surged nearly 4 percent to $45.64, briefly touching $47.

Hayes’ Forecast and Market Reaction

Hayes based his forecast on the growing role of stablecoins within decentralized finance. He argued that stablecoin-driven activity would expand Hyperliquid’s revenue streams. According to Hayes, the exchange’s annualized fees could reach $258 billion compared to $1.2 billion today.

Following these remarks, the market reacted with cautious optimism. Traders responded to the bold projection by increasing exposure to HYPE, pushing its price higher. Despite the rally, the token remains about 7 percent below its all-time high near $50.

Hyperliquid’s native token has seen sharp moves in recent months, but Hayes’ remarks added a new long-term narrative. He stated that decentralized platforms like Hyperliquid will benefit as more users demand transparent trading systems. The forecast, while ambitious, placed Hyperliquid at the center of upcoming growth in DeFi.

Hyperliquid’s Market Position

Hyperliquid has rapidly grown into a leader in decentralized perpetual futures. According to data provider Redstone, it controls over 75 percent of this market. This share came in less than two years, surpassing rivals such as dYdX.

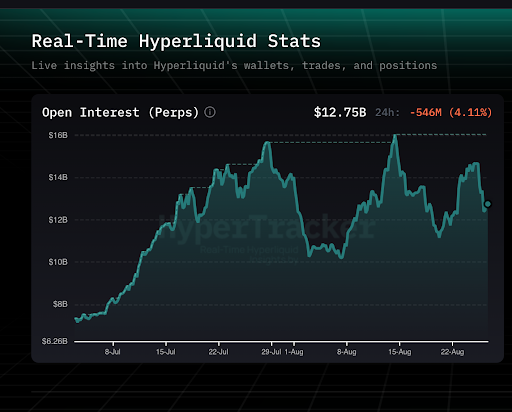

The platform’s performance data reflects growing demand. Total open positions reached 198,397 while open interest climbed above $15 billion. Wallet equity also peaked at $31 billion, and trading volume hit $1.56 billion over the weekend.

Transaction fees have also been strong. This month, fees matched July’s high of $93 million, showing consistent activity. The data suggest that liquidity is deepening, giving Hyperliquid an advantage in attracting traders.

With a total value locked of $685 million, Hyperliquid is approaching levels last seen in February 2024. This suggests that users are keeping funds within the platform, which could support future stability. The exchange’s decentralized order-book model has also been a key draw for traders.

Future Growth and Market Challenges

Hayes’ bullish outlook depends on broader adoption of stablecoins and continued growth in decentralized exchanges. Stablecoins are increasingly central to crypto trading, and their rise could increase activity on Hyperliquid. If this happens, fee revenues may scale toward Hayes’ projections.

However, the forecast remains speculative and depends on several conditions. Market competition, regulatory clarity, and technology development will play important roles in shaping outcomes. While Hyperliquid holds a strong position now, it faces pressure from both centralized and decentralized competitors.

The crypto market has been uneven this year, with Bitcoin and other tokens showing mixed trends. Hyperliquid’s ability to maintain momentum will depend on how it adapts to changing conditions. Its strong user base and high liquidity provide advantages, but long-term performance is uncertain.