- Injective’s $4B valuation collapsed to $300M as fundamentals failed to support the vertical rally.

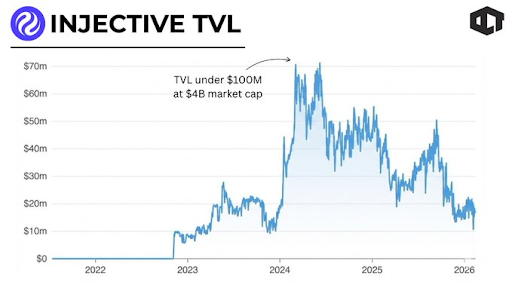

- TVL under $100M at $4B market cap exposed a critical gap that other DeFi chains exploited quickly.

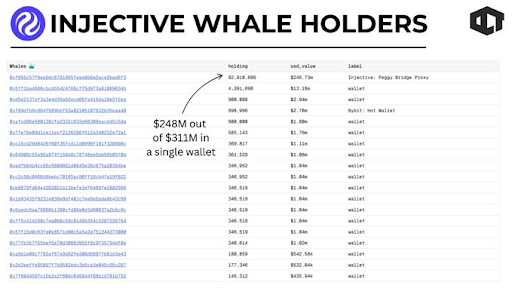

- Supply concentration in infrastructure wallets reduced tradable float, amplifying volatility risks.

Injective has lost 90% of its value in a dramatic market correction. The token fell from a $4 billion market cap to roughly $300 million.

According to Our Crypto Talk, the warning signals were visible all along. The collapse raises questions about what investors missed during the rally.

Valuation Outpaced Fundamentals

Injective’s market cap climbed close to $4 billion in 2024.

The project promoted on-chain derivatives and fast execution as key strengths. The rally looked vertical on price charts. But vertical moves need solid fundamentals beneath them.

$INJ lost 90% of its value

> A $4B market cap.

> Under $100M in TVL.

> Now sitting near $300M.The warning signs were always there.

Let's break them down 👇

1️⃣ THE VALUATION RAN TOO FAST

In 2024, Injective’s market cap pushed close to $4 billion.

The narrative was strong.… pic.twitter.com/G9hJXiH7PE

— Our Crypto Talk (@ourcryptotalk) February 14, 2026

Our Crypto Talk pointed out that liquidity eventually dried up. Risk appetite cooled across crypto markets. Questions about usage depth and capital retention surfaced.

The current $300 million valuation suggests the earlier price tag reflected future growth that never arrived.

Technical Structure Collapsed

The 2023 breakout zone served as a foundation before the rally. In late 2025, Injective tried to reclaim the $10 level but failed.

Our Crypto Talk highlighted that this rejection mattered significantly. When a token cannot hold previous breakout areas during market bounces, buyer conviction is absent.

The trend channel remained intact to the downside. RSI indicators never regained meaningful strength. The shift wasn’t just a temporary dip.

Support levels flipped to resistance. The path of least resistance stayed lower throughout the decline.

TVL Gap Exposed Weakness

At a nearly $4 billion market cap, total value locked sat under $100 million. Our Crypto Talk emphasized that this gap was impossible to ignore.

DeFi operates in a brutally competitive environment. Other chains offered cheaper fees and deeper liquidity pools.

TVL measures how much capital trusts an ecosystem. When capital doesn’t stick around, prices cannot sustain elevated levels.

The market eventually corrects these imbalances. That correction hit Injective hard. The fundamentals simply didn’t support the valuation premium.

Supply Concentration Created Vulnerability

One wallet holds roughly $248 million of the $311 million market cap. Our Crypto Talk identified this wallet as a “Peggy Bridge Proxy.” This represents infrastructure rather than a single whale. It likely involves protocol or bridge-controlled liquidity.

Even infrastructure wallets reduce the effective circulating supply. When large portions sit in structured wallets, the tradable float becomes thinner.

Thin float creates higher volatility. It enables faster drawdowns and makes recoveries harder. The concentration amplified Injective’s price weakness.

According to CoinGecko data, Injective currently trades at $3.20. The 24-hour trading volume stands at $35.96 million. The token posted a 6.28% gain in the last 24 hours. It’s up 1.25% over the past seven days.

Our Crypto Talk outlined what a recovery would require. TVL needs meaningful growth. Derivatives volume must expand significantly. Broader participation beyond whales becomes essential. The technical structure needs to reclaim lost levels convincingly.

At $300 million, expectations sit much lower than at $4 billion. The narrative premium has disappeared. Whether Injective can rebuild remains uncertain. The market will demand proof of real usage and sustained capital inflows before rewarding the token again.