Key Insights:

- Ethereum outperformed Bitcoin by 72% since April, and has pushed the ETH/BTC ratio to its highest level since January.

- The ETH weekly spot trading volume beat Bitcoin’s for the first time in over a year.

- The ETH/BTC ETF Holding Ratio more than doubled, in a show of strong investor preference for Ethereum.

A shift in investor sentiment is shaking up the crypto space. According to a new report from CryptoQuant, Ethereum is beginning to take center stage as traders move away from Bitcoin and towards the alts.

After more than a year of Bitcoin dominance, Ethereum and the rest of the altcoin market are showing signs of a new growth cycle, and the data backs it up.

Ethereum has outpaced Bitcoin by a stunning 72% since April. This level of strength has lifted the ETH/BTC price ratio from 0.018 to 0.031, its highest level since January of last year.

Spot Trading Volumes And The Ongoing Shift

According to a recent report from CryptoQuant, one of the most telling signs of this shift is the trading volume.

For the first time since June of last year, Ethereum’s spot trading volume has overtaken Bitcoin’s. Last week alone, ETH recorded $25.7 billion in spot volume compared to Bitcoin’s $24.4 billion. While the difference might seem small, it is a major turning point in market dynamics.

First time in over a year: ETH spot volume > BTC

Last week, ETH spot trading hit $25.7B vs. BTC’s $24.4B, pushing the ETH/BTC spot volume ratio above 1 for the first time since June 2024.

Investors are rotating to ETH and Altcoins. pic.twitter.com/X7mBFVCg5Y

— CryptoQuant.com (@cryptoquant_com) July 23, 2025

When Ethereum’s spot volume rises above that of Bitcoin, it shows that traders are becoming more active in ETH markets. It also shows that investors are willing to bet on Ethereum’s short- and mid-term performance, even amid market uncertainty.

These numbers aren’t just a one-off anomaly. They show a larger picture that could define the coming months.

ETFs Mirror the Market Rotation

ETF activity is another source of fuel for this trend. For context, the ETH/BTC ETF Holding Ratio has jumped from 0.05 to 0.12 in recent months. That means that funds are allocating more capital to Ethereum than they are to Bitcoin. They are allocating more than double what they were just months ago.

This isn’t just retail investors getting excited. ETF trends often show institutional sentiment. When large funds adjust their holdings to favor ETH over BTC, it speaks volumes about long-term confidence in Ethereum’s performance.

The ETF data indicates a clear narrative: Ethereum is no longer playing second fiddle. It’s becoming a serious competitor to Bitcoin for institutional portfolios and long-term strategies.

Ethereum Faces Lower Sell Pressure Than Bitcoin

Another interesting metric that supports Ethereum’s current rally is the ETH/BTC Exchange Inflow Ratio. This ratio shows how many coins are being sent to exchanges, which is usually a sign of selling intent.

The data indicates that fewer ETH tokens are being moved to exchanges compared to Bitcoin.

In simpler terms, fewer Ethereum holders are looking to sell. This reduction in sell pressure also contributes to price stability and encourages investors to continue accumulating the asset. It also indicates that ETH investors are more confident in the asset’s future, which further fuels its performance.

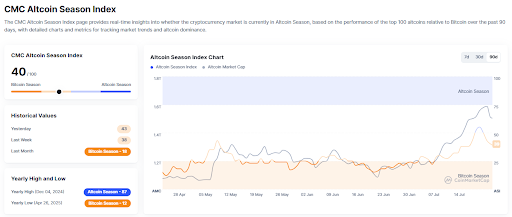

Altcoin Season Might Be Starting

Ethereum isn’t alone in this. The general altcoin market is also showing fresh strength.

For example, on July 17, altcoin spot trading volume surged to $67 billion, which is the highest it has been since March.

Historically, periods of altcoin market expansion tend to follow or align with Ethereum rallies. Traders tend to see altcoins as higher-risk, higher-reward bets. Because of that, they tend to pour in when confidence in the overall crypto market grows.

What we’re witnessing now is the beginning of a possible “altcoin season”.

Overall, whether this trend continues will depend on more general market conditions.