Iran’s crypto market fell sharply in 2025 due to war, exchange hacks, sanctions, and shifting stablecoin strategies, says TRM Labs.

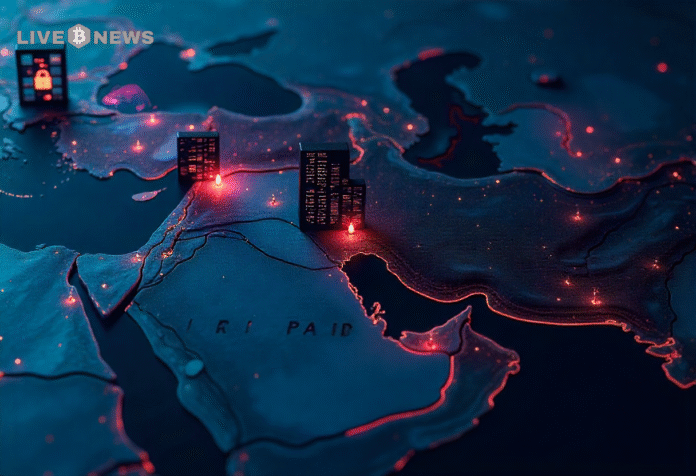

Iran’s cryptocurrency market experienced a significant decline in 2025, according to a new report from blockchain analytics firm TRM Labs. The decline in activity can be attributed to a range of factors, including political instability, a massive cyberattack, and international sanctions, which have interfered with the country’s digital asset ecosystem.

Iran Sees $3.7B in Crypto Flows as Inflows Collapse in June and July

The amount of money transfers connected with Iranian platforms and entities has been about 3.7 billion US dollars in January-July 2025. This was an 11 percent decline when compared to the same period in 2024. The biggest fall was recorded in June and July. Inflows in June and July declined by over 50 percent and 76 percent, respectively, as compared to the same period last year.

Related Reading: Global Crisis Alert as Iran-US-Israel Tensions Explode Amid Economic Chaos— Unique Solution Proposed? | Live Bitcoin News

This steep decline was witnessed at a time when Iran and Israel were becoming increasingly hostile. A 12-day war that started on June 13 came after the collapse of nuclear talks. The war caused power blackouts in Iran. These were due to cyber and military actions by Israel and the internal decision by Iranian authorities to limit services.

Meanwhile, a cyberattack at the same time on Nobitex, the largest Iranian crypto exchange, further undermined market stability in the hack. On June 18, the site lost 90 million US dollars in digital assets that were stolen. The attack caused liquidity disruption, and the users had to find alternatives. Nevertheless, Nobitex facilitated over 87 percent of the Iranian-related crypto transactions in 2025. About 2 billion US dollars worth of that volume was transacted using the TRON network, most of which were USDT and TRX tokens.

A similar tremor has been caused by the mass delisting by Tether as well. On July 2, Tether blacklisted 42 addresses linked to Iran. Many of these were connected to Nobitex and wallets possibly tied to sanctioned groups. As a result, Iranians lost access to key stablecoins. These digital assets had become a popular way to trade and save money due to the unstable national currency.

New Tax Law Signals Iran’s Push to Regulate Crypto Market

Despite the overall negative trend in the activity, outgoing crypto flows remained rather stable. According to TRM Labs, digital assets are still utilized as a method of capital flight, especially since there is still limited access to international banking channels. Cryptocurrency is an inflationary hedge and the hedge against economic uncertainty among many Iranians.

Following the actions of Tether, Iranians started to change their attitude to USDT, both in terms of users and exchanges. Others switched to the DAI stablecoin on the Polygon network. This transition helped users to retain access to digital dollars without the risk of being frozen in the future.

In August 2025, the Iranian government enacted a new law that taxes capital gains on crypto trades. The legislation considers digital assets as real estate and gold, which means that the state intends to establish formal regulation of the growing market.

In addition, TR Labs also stated that Iran is still using cryptocurrency to acquire drone parts, AI hardware, and other sensitive purchases through foreign suppliers. Moreover, a system of KYC shortcut services within Iran has aided users in dodging verification on foreign sites.

The crypto industry still plays an important role for many people in Iran. However, recent events have exposed serious problems in the country’s digital infrastructure. Ongoing political and economic pressure continues to affect the sector. As a result, Iran’s cryptocurrency ecosystem remains highly vulnerable to external shocks and poor internal management.