With the rumors of crypto ETF expansions and a wave of bullish technical signals, the XRP price is once again topping talks in the crypto market, as analysts revisit targets that were previously deemed unlikely.

Following these expectations, the question on everyone’s mind is: Is the long-awaited $10 XRP price breakout finally happening? And if so, how does it stack up against new entrants like PayDax Protocol (PDP), which is slowly gaining institutional interest?

Analysts Revisit the $10–$20 XRP Price Scenario

XRP has found renewed momentum on the back of institutional interest. The launch of the Rex Osprey XRP ETF pulled in $24 million in inflows within its first 90 minutes, signaling a strong appetite.

With more than 18 ETF applications under SEC review, Ripple CEO Brad Garlinghouse has hinted at approvals before the year’s end. Analysts like Jake Claver believe this could catapult the XRP price into the $10–$25 range.

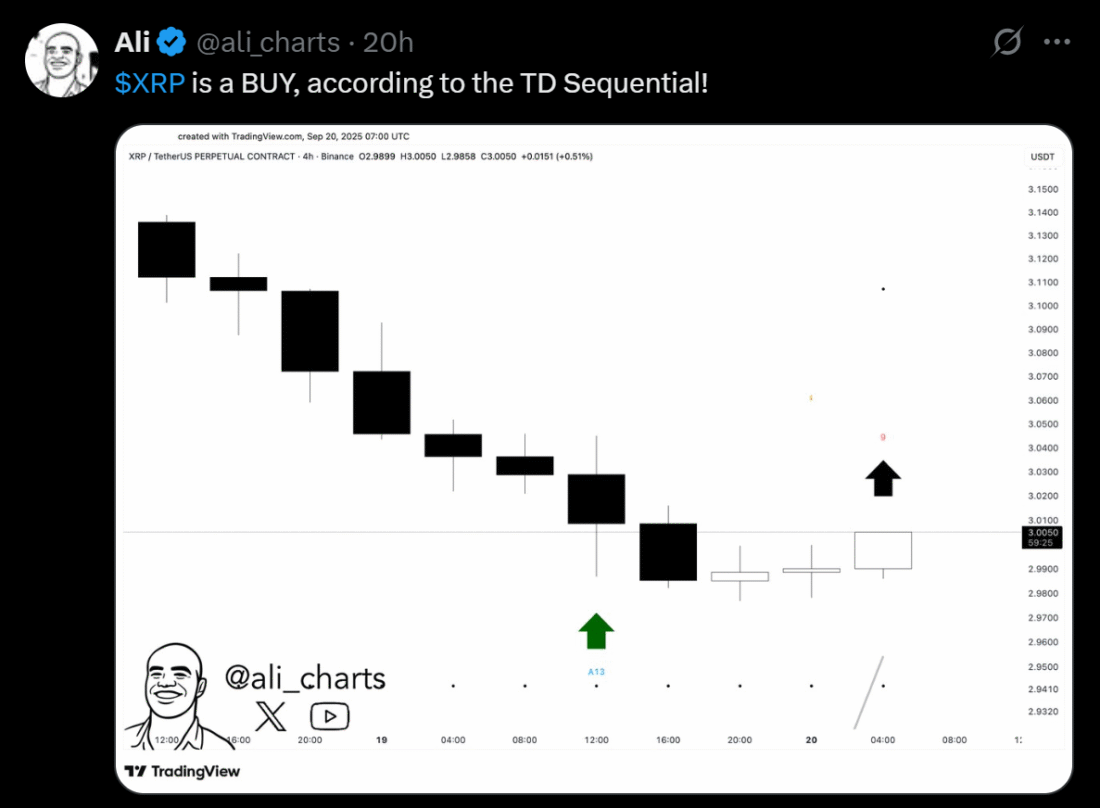

Technical indicators are reinforcing the optimism. A bullish MACD crossover, a pattern that previously triggered rallies of over 90%, has traders watching closely. Chartists Javon Marks and Ali Martinez also point to accumulation structures and buy signals that could push XRP first toward $9.90 and, if cleared, potentially $20.

PayDax (PDP) Turns Assets Into Liquidity

Where the XRP price relies heavily on institutional catalysts, PayDax Protocol (PDP) builds utility directly for individuals. Its core function allows users to borrow stablecoins without selling their assets. Crypto holders can pledge Ethereum, Solana, or even XRP itself at flexible loan-to-value (LTV) ratios of up to 97%.

The real breakthrough, however, lies in real-world asset integration. Collectors can tokenize a luxury watch authenticated by Sotheby’s, or investors can collateralize a golden asset secured by Brinks. Instead of lying dormant in safes, these assets generate liquidity on-chain, bridging traditional wealth with decentralized finance.

This borderless approach turns previously illiquid holdings into productive capital, a feature that other crypto assets have never offered.

Stakers and Lenders at the Heart of the System

PayDax doesn’t just help borrowers; it also opens up new opportunities for lenders and stakers. By funding loans that are overcollateralized, lenders can earn up to 15.2% APY, which is significantly higher than what banks offer. With transparency, every return goes directly to participants, not to middlemen.

Stakers play an equally vital role through the Redemption Pool. Acting as decentralized insurers, they cover shortfalls when borrowers default, earning premiums that can reach up to 20% APY. This transforms risk into a yield-generating opportunity, distributing roles to the community itself.

For advanced participants, leveraged yield farming introduces another layer of potential, offering strategies that can deliver an APY of more than 40%.

Infrastructure and Trust That Stand Apart

DeFi projects often stumble on credibility, but PayDax has anchored its system in world-class infrastructure. Christie’s and Sotheby’s authenticate tokenized RWAs, while Brinks and Prosegur safeguard physical collateral.

Chainlink oracles provide real-time asset pricing, Jumio enables compliance-grade identity verification, and MoonPay makes fiat on- and off-ramps seamless through debit and credit cards.

Additionally, PayDax operates with a fully doxxed team and an in-office development unit. Regular AMAs, podcasts, and video updates keep the community informed, while audits from Assure DeFi and registered business status add further layers of trust.

Why It Is Time to Get the PDP Token

The momentum around ETFs could very well send the XRP price toward $10, rewarding those who have held through years of uncertainty. But XRP is already a multibillion-dollar asset, meaning its growth, while solid, is capped by scale.

PayDax Protocol (PDP), on the other hand, is still in its early stages, with a presale currently priced at just $0.015 per token and adoption already beginning. With a high ROI in place, analysts believe that it can replicate Avanti (AVNT)’s recent surge.

Every loan issued, every staking commitment, and every Redemption Pool payout locks PDP deeper into the system’s mechanics, creating a self-reinforcing cycle of demand. For those who move early, the chance to help shape and benefit from the first true People’s DeFi Bank is here right now.

Join the PayDax Protocol (PDP) presale Today.

Join Paydax Protocol (PDP) presale | Website | Whitepaper | X (Twitter)|Telegram

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.