Between Binance and new entrants, LST challengers shaking the Solana market, liquid staked SOL reaches 57M tokens, 13.6% staked supply.

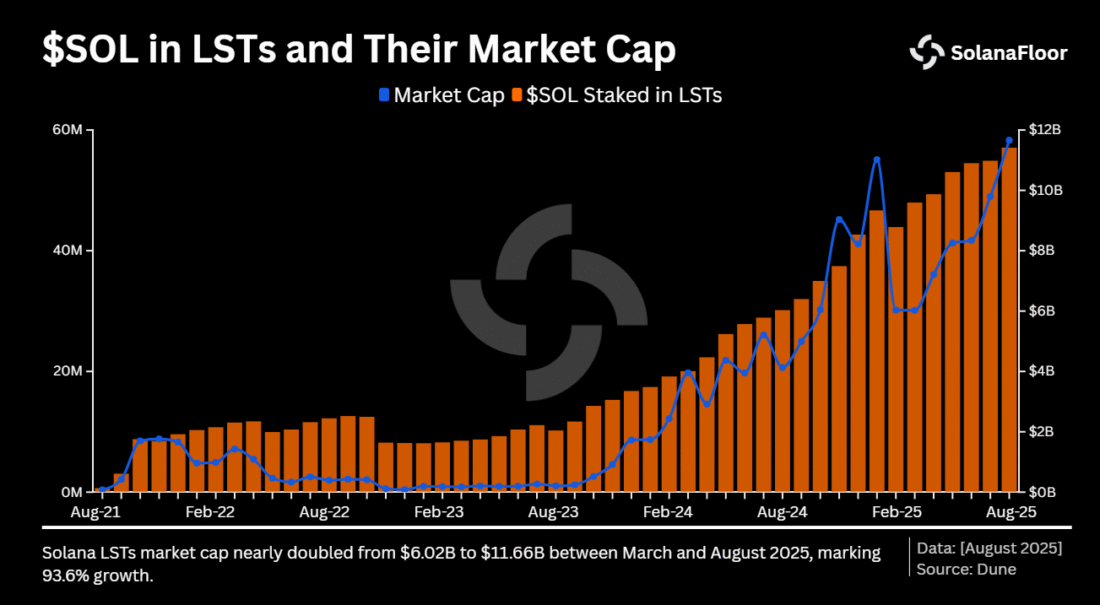

SOL that was staked with liquid assets came close to reaching an all-time high of 57 million tokens. This constitutes 13.6% of the entire supply that has been staked on Solana.The increase highlights a powerful trend toward liquid staking in 2025.

Source – Solana floor

Solana Floor and Dune analytics suggest that liquid staking tokens (LSTs) have grown exponentially this year. Its market cap had almost doubled from 6 billion in March to 11.66 billion in August. The milestone represents a milestone in Solana DeFi development.

LST Pools Dominate as Binance Token Surges

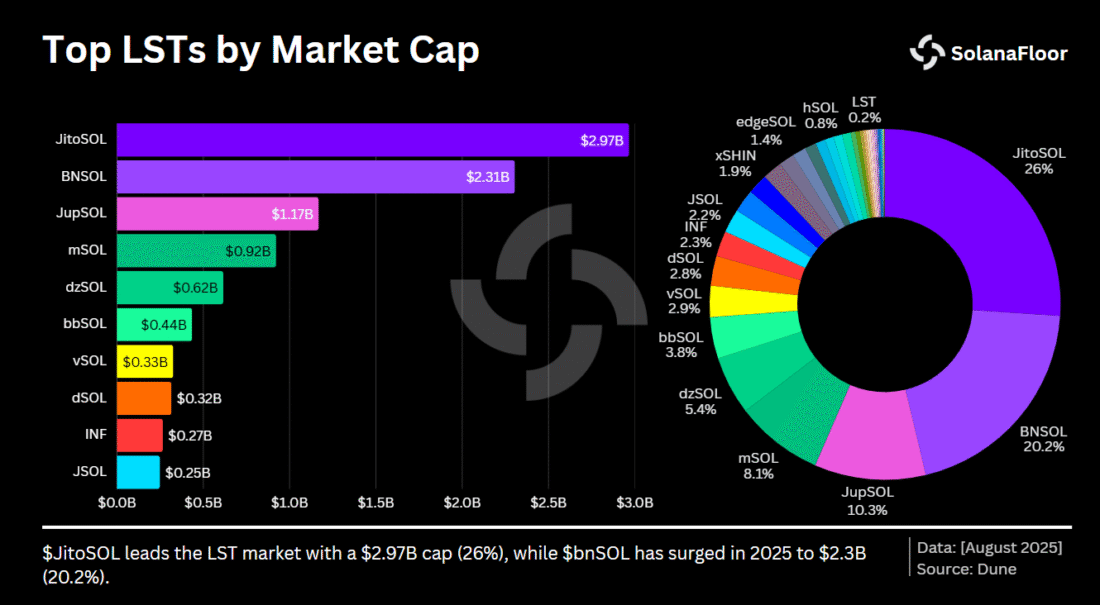

There are three types of Solana LST market such as protocol pools, centralized exchange-issued tokens (CEX-issued LSTs), and validator-issued LSTs.With 51.4% of the market, pools are in the lead.

Exchanges such as the Binance round badges: $bnSOL and Bybit: $bbSOL are introduced centrally.

Source – Solana floor

At this moment, these are the tokens that hold a 24.1% share of the market for LST. This year alone, Binance $bnSOL has surpassed a market cap of over 2.3 billion dollars.

Tokens issued by validators also increased by adding $720 million in August. They have a market share of 18.8 percent and a market capitalization of 2.2 billion. This heterogeneous environment is the reason why the sector is evolving very fast.

New Entrants Challenge the Market King

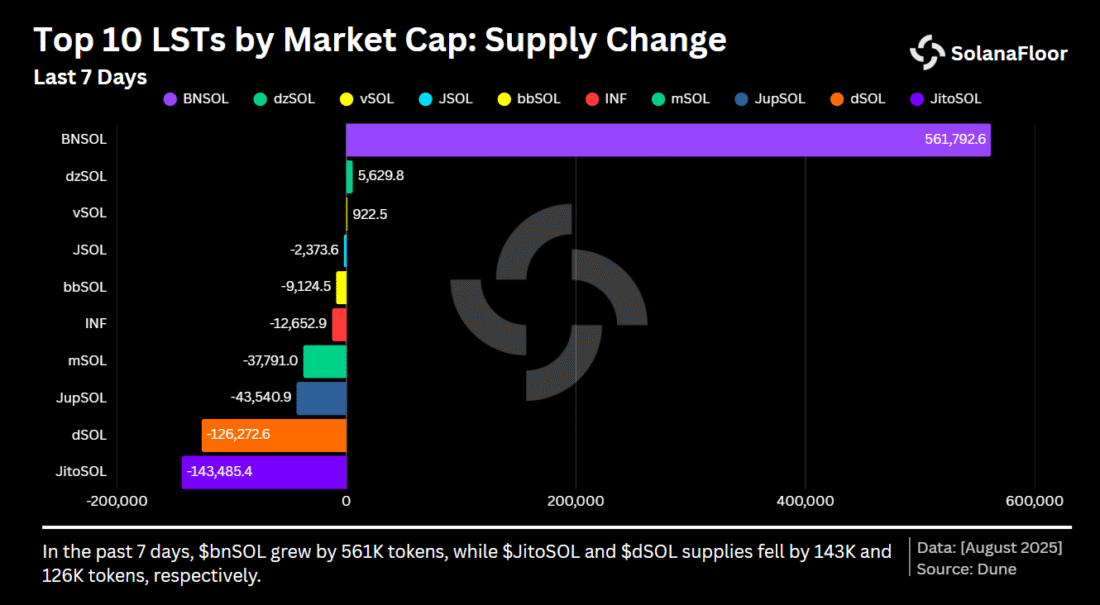

Source – Solana floor

The market leader in terms of market capitalization, which is a share of the market, is still JitoSOL with $2.97 billion. But the fast growth of $bnSOL makes it a possible competitor. $dzSOL was launched in January 2025 and already holds 5.4% of the market.

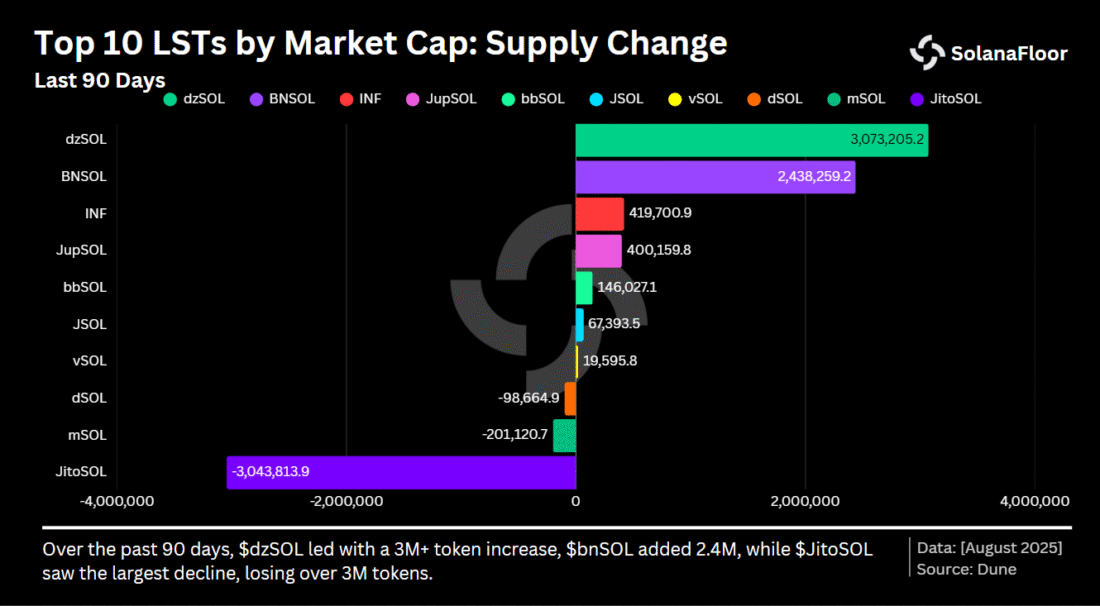

Source – Solana floor

Recent supply shows the changing balance of power. This week, $bnSOL included 561,000 tokens, and the $JitoSOL supply decreased by 143,000. Compared to others, over 90 days, the number of tokens in the hands of $dzSOL increased by more than 3 million.

There is not much growth potential, as liquid staking only takes up 13.65% of the total staked SOL. As a market shakeup approaches, the entrance of $bnSOL would be imminent.