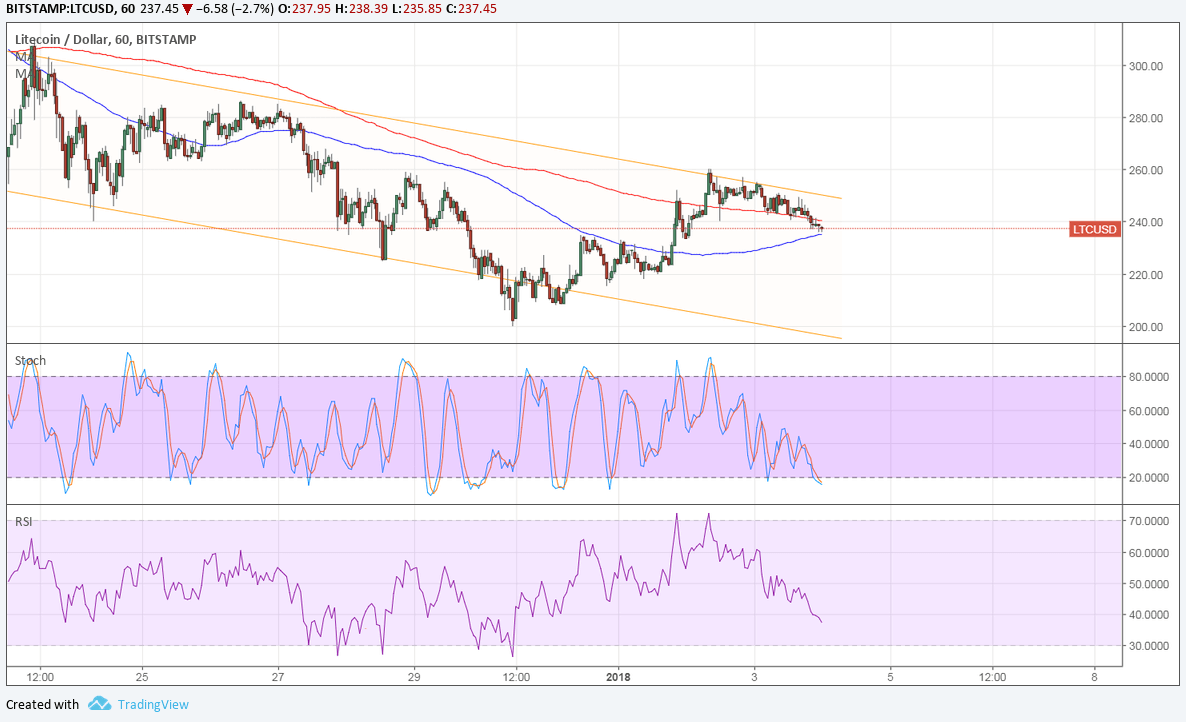

LTCUSD continues to trend lower and appears to be bouncing off the channel resistance highlighted in an earlier post. Bearish momentum could be picking up as oscillators turn lower.

In particular, RSI is heading south while LTCUSD follows suit as bearish pressure is in play. Stochastic is also on the move down but is already dipping into oversold territory to reflect exhaustion among sellers.

The 100 SMA is below the longer-term 200 SMA for now but seems to be attempting an upward crossover. This could draw more bulls to the game and even trigger an upside break of the resistance around $250.

In that case, a reversal could be due for LTCUSD as it trails other cryptocurrency rivals in gaining a bit more bullish traction to start the year. However, news that its founder liquidated all of his litecoin holdings citing conflict of interest could keep a lid on price gains.

At the same time, the recovery in the dollar on the heels of a less downbeat FOMC minutes could keep the downtrend in place for LTCUSD. Most policymakers assured that gradual rate hikes are in the cards even though many remain wary of weak inflation. Besides, some emphasized that the strong pace of hiring could keep price levels supported.

The ISM manufacturing PMI showed exactly that as the prices component posted a strong gain, even while the jobs index dipped slightly. Then again, indices for inventories turned lower, suggesting that businesses could pick up production to replenish those.

The upcoming ADP non-farm employment change could have a strong impact on the dollar as this would set the tone for the NFP on Friday. An improvement from 190K to 191K in December is eyed, and a higher than expected increase could keep positive NFP expectations in play.

On the other hand, disappointing results could once again douse rate hike hopes and mean dollar losses, which litecoin might be able to take advantage.