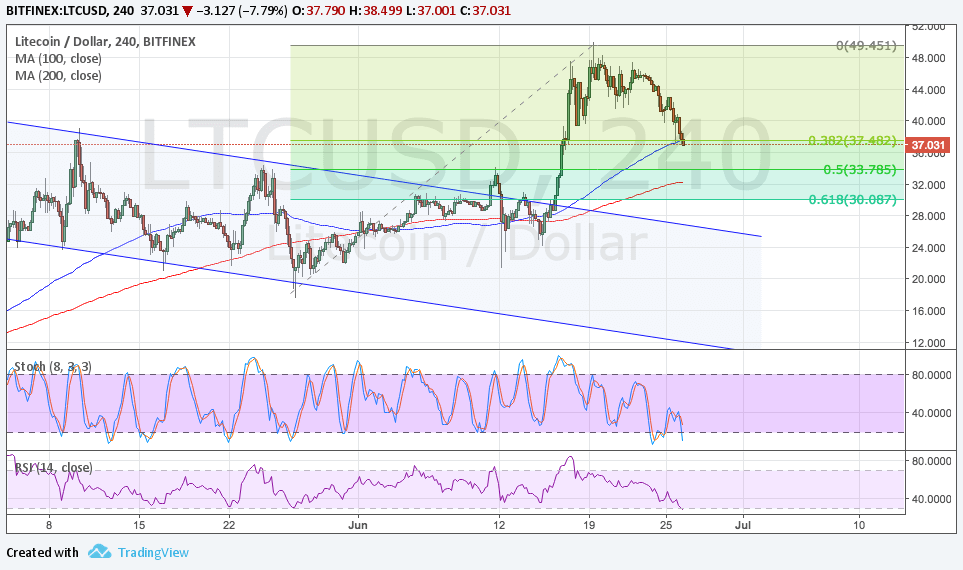

LTCUSD recently surged past its descending channel resistance to signal a reversal from the selloff. Price zoomed up to the $49.45 area before starting a pullback from the breakout.

Applying the Fibonacci retracement tool on the latest swing high and low on the 4-hour time frame shows that price could find support at the 61.8% Fib that coincides with the broken channel resistance around $30. For now, LTCUSD is testing the 38.2% correction level that lines up with the 100 SMA dynamic inflection point.

Speaking of moving averages, the 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. The gap between the moving averages is getting wider to reflect strengthening buying pressure. In other words, the climb is more likely to resume than to reverse.

A larger correction could last until the 200 SMA just below the 50% Fibonacci retracement level. The line in the sand for a correction is the broken channel resistance at $28, and a break below this area could signal that selling pressure is back in play.

Stochastic is heading south to signal that sellers are in control of LTCUSD direction for now. RSI is also moving down so LTCUSD might follow suit. However, both oscillators are already dipping into the oversold region to signal that sellers are feeling exhausted and that buyers could regain control soon.

Cryptocurrencies have been on the back foot recently after the ethereum flash crash on GDAX sparked doubts about the stability and security of digital assets. This follows a few remarks from big names, suggesting that bitcoin could be in for declines from there, weighing on sentiment for the rest of the industry.

Meanwhile, the Fed’s emphasis on its plan to unwind balance sheet holdings and to hike interest rates one more time before the year ends has driven stronger dollar demand. This could continue to keep the currency supported against litecoin unless data disappoints and casts doubts on tightening again.