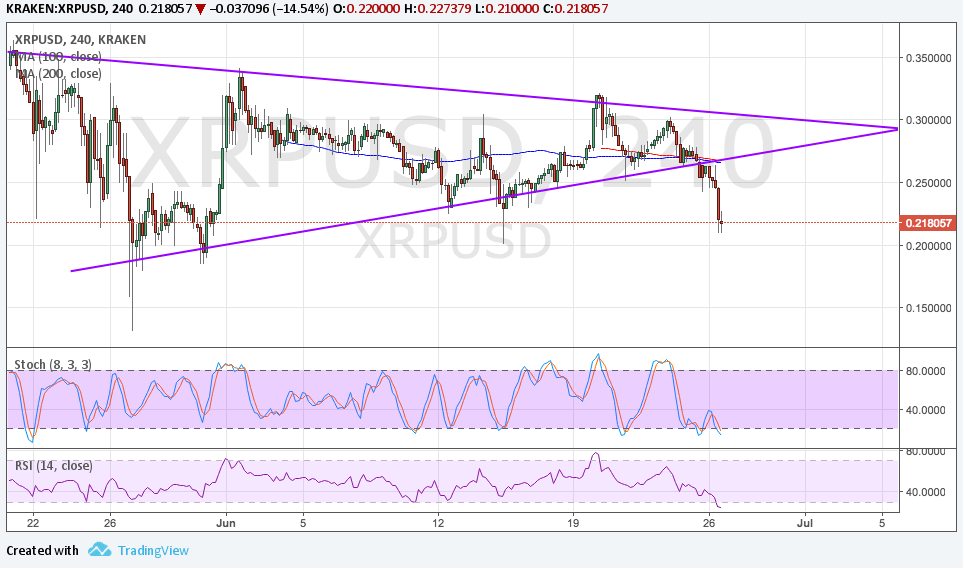

Ripple has formed lower highs and higher lows to create a symmetrical triangle, but a breakout has recently taken place. Price moved below support at the 0.2500 mark to signal that bearish momentum is kicking into high gear.

The chart pattern spans 0.1500 to 0.3500 so the resulting drop could be of the same size, possibly taking Ripple down to the 0.0500 level. The 100 SMA is below the longer-term 200 SMA so the path of least resistance is to the downside, which basically means that the drop is more likely to continue than to reverse.

However, stochastic is already indicating oversold conditions while RSI is dipping into that region as well. If sellers take it easy from here, buyers could take advantage and spur a bounce.

Nearby resistance is located at the broken triangle support, which might also have a lot of bears waiting to join the drop. This is also in line with the moving averages, which usually hold as dynamic inflection points.

Digital currencies have taken a hit recently after skepticism has built up owing to bearish remarks from big name analysts and a couple of setbacks in the industry. Earlier on, some bitcoin exchanges have reported outages due to unprecedented levels of traffic and trading activity while ethereum suffered a flash crash on the GDAX.

This has led investors to scramble to book their recent profits on the rallies, including on Ripple, before the end f the month and quarter or before these gains are completely erased. Dollar demand has picked up, in contrast, due to the Fed’s decision to hike rates and confirm that they could have room for one more.

The company behind Ripple is focused on building a better bitcoin as it wants to handle transaction volume on a higher scale. The company approaches banks with its enterprise software, along with the Interledger Protocol. They propose a corresponding banking paradigm in which banks with no direct relationship rely on intermediaries in order to send payments to each other.