Chainlink sees 2.07M LINK outflow and a rare Golden Cross, fueling hype of a potential breakout above $25.

Chainlink has attracted renewed attention after large outflows from exchanges and technical signals pointing toward a possible breakout. Traders and analysts are watching the token closely as it trades near its highest level in years, and whale activity continues to rise.

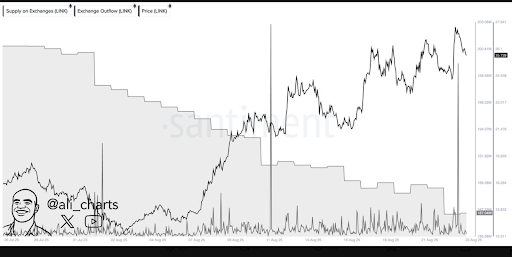

Whale Activity and Exchange Outflows

Chainlink (LINK) saw a withdrawal of 2.07 million tokens from exchanges within 48 hours, according to on-chain analyst Ali Charts. This large movement suggests reduced selling pressure on exchanges, which many observers view as a positive sign for price stability.

Data from analytics firm Santiment reported that whale transactions, defined as transfers above $100,000, climbed to a seven-month peak of around 4,624. Active LINK addresses also increased to 6,463, the highest level in eight months. Rising address activity combined with exchange outflows has often been linked to periods of price expansion in the past.

The LINK price is around $25.40, showing growth after breaking resistance levels monitored since the spring. Santiment also observed that social sentiment turned more favorable, with positive commentary outweighing negative discussions on major platforms. This shift in sentiment has added further strength to the bullish outlook for LINK.

Chainlink Golden Cross and Technical Outlook

Technical traders are paying close attention to the appearance of Chainlink’s third-ever monthly Golden Cross. A Golden Cross occurs when the 50-day moving average rises above the 200-day moving average. In previous instances, LINK experienced rapid price gains following this formation.

Rekt Fencer, another market analyst, noted that the last two Golden Cross events led to “vertical candles” in LINK’s price charts. Traders are now debating how far the token could rise if history repeats itself. Analysts have set near-term targets in the $29 to $32 range, while some longer-term projections extend toward $46 if momentum continues.

At the same time, caution remains in the market. Analysts suggest that failure to maintain support in the mid-$20s could bring a retest of lower levels near $20 or even the high teens. Market watchers are monitoring whether LINK can hold above $24, which is seen as an important price zone for sustaining bullish momentum.

Chainlink’s Strategic Role and Future Prospects

Beyond short-term trading activity, Chainlink’s position in the blockchain ecosystem is becoming more important. The project has partnered with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, to provide institutional-grade pricing data. This integration enables more than 2,000 applications to access reliable foreign exchange and precious metals data on-chain.

Chainlink’s new Reserve model has also created additional scarcity by locking half of staking revenue into time-locked LINK, reducing supply each month. In Q2 2025, on-chain data showed 1.1 million tokens accumulated by whales and nearly 9,600 new wallets created. These developments support arguments that LINK is establishing a stronger base for growth as tokenization of real-world assets expands toward the $30 trillion mark projected for 2030.

Analysts believe that the mix of whale accumulation, reduced exchange supply, and rising on-chain adoption gives Chainlink an important role in bridging traditional finance with decentralized platforms. The recent 2.07 million LINK outflow combined with the monthly Golden Cross has fueled market expectations, making the coming weeks critical for the token’s trajectory.