Hong Kong construction company Ming Shing Group Holdings has announced plans to buy a staggering 4,250 Bitcoin for $483 million.

The deal has set up Ming Shing as the largest Bitcoin treasury holder in Hong Kong.

According to BitcoinTreasuries.NET, the buy would put the company ahead of Buyaa Interactive International, which holds 3,350 Bitcoin. The announcement comes just as Bitcoin trades above $113,000, with Ming Shing paying an average of $113,638 per coin.

Details of the Bitcoin Buy

Ming Shing signed the agreement with Winning Mission Group Limited. It will also involve two British Virgin Islands-based in structuring the transaction. Winning Mission will transfer the Bitcoin in exchange for a $241.48 million note and warrants for 201.23 million shares.

Another firm, Rich Plenty Investment, is expected to receive a similar package and issue a promissory note to Winning Mission for half of the Bitcoin.

The notes carry a 3 per cent annual interest rate and a maturity period of 10 years.

JUST IN: 🇭🇰 Hong Kong construction company Ming Shing Group to buy 4,250 #Bitcoin worth $483 MILLION.

Nothing stops this train 🚀 pic.twitter.com/zWKxG4C103

— Bitcoin Magazine (@BitcoinMagazine) August 21, 2025

Moreover, Warrants cover 402.47 million shares in total, with a 12-year exercise window at $1.25 per share. Both the notes and warrants include a 4.99 per cent beneficial ownership cap to prevent single parties from gaining too much control.

If the transaction closes by December 31, Ming Shing’s Bitcoin holdings are expected to rank among the largest corporate treasuries worldwide.

Shareholders and Dilution Risk

While the deal is a big deal, it does introduce major risks for shareholders. Ming Shing currently has fewer than 13 million shares outstanding. If the convertible notes are exercised but warrants remain untouched, the share count will rise above 415 million.

Current shareholders would then hold just over 3 per cent of the company.

In the worst case, if all notes, warrants and interests are converted, the share count could rise to near 939 million. That scenario would cut existing ownership down to about 1.4%.

Still, shareholder approval is needed before the company can authorise more shares, since it currently has only 100 million authorized.

Stock Price Reaction to Bitcoin Bet

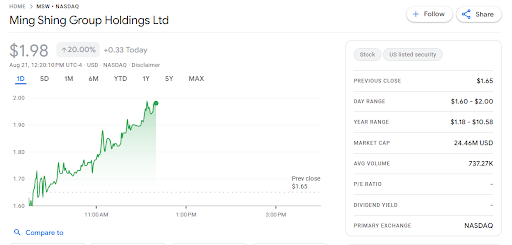

The market reacted quickly to the announcement. August 21 saw Ming Shing’s stock rise nearly 10 per cent to $2.15 before settling back to $1.65. Despite the short-lived surge, the company’s shares have been under pressure for much of the year.

According to Google Finance, Ming Shing stock has lost more than 70% of its value over the past 12 months. This includes a 44% drop in the past month and a 24% fall in the last five days alone.

CEO Wenjin Li said the Bitcoin purchase is part of a plan to strengthen the balance sheet. “We believe the Bitcoin market is highly liquid and the investment can capture the possible appreciation of Bitcoin and increase the company’s assets,” Li explained.

In all, Ming Shing’s decision is part of a larger trend of corporate Bitcoin adoption over the last few years. For example, this year, several major Asian and U.S. companies have announced treasury investments in Bitcoin.

This wave of adoption shows that institutional interest in Bitcoin is no longer limited to MicroStrategy, as more companies jump on the bandwagon.