Rising U.S. inflation sparks $291M outflows from Bitcoin and Ethereum ETFs as markets brace for possible Fed rate cuts.

Rising inflation data in the United States triggered outflows from leading spot Bitcoin and Ether ETFs on Friday. The Federal Reserve’s preferred inflation measure showed higher-than-expected core price growth. This prompted investors to withdraw funds from crypto ETFs after weeks of steady inflows.

Core Inflation Climbs to 2.9% in July

The Commerce Department reported that the core Personal Consumption Expenditures (PCE) index rose 2.9% in July. This marked the highest annual rate since February and was in line with analyst expectations. On a monthly basis, core prices rose 0.3%.

The PCE index excludes food and energy costs and is considered the Federal Reserve’s key inflation measure. The all-items index rose at a 2.6% annual rate while monthly growth stood at 0.2%. Services prices led the increase with a 3.6% annual rise, compared with just 0.5% for goods.

President Donald Trump’s trade tariffs were cited as a factor behind the price pressures. The administration placed a 10% tariff on all imports in April and expanded duties since then. These measures have increased import costs, contributing to inflation trends.

Investor Reaction in Crypto ETF Markets

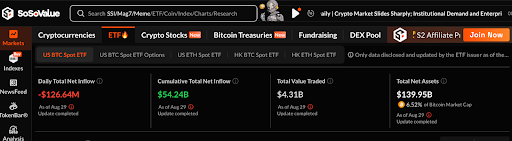

Spot Bitcoin ETFs saw $126.64 million in outflows, the first decline since August 22. Ethereum ETFs posted even larger outflows, losing $164.64 million after five consecutive days of inflows. Total assets under management dropped to $139.95 billion for Bitcoin and $28.58 billion for Ethereum.

Among Bitcoin funds, Fidelity’s FBTC reported the steepest withdrawal at $66.2 million. ARK Invest and 21Shares’ ARKB saw $72.07 million in outflows, while Grayscale’s GBTC lost $15.3 million. BlackRock’s IBIT gained $24.63 million and WisdomTree’s BTCW added $2.3 million, offsetting some of the losses.

Ethereum ETFs had previously attracted over $1.5 billion in inflows earlier in the week. The reversal came as inflation data pressured investor sentiment. Market participants moved to reduce exposure while awaiting further economic updates.

Fed Policy Outlook and Market Conditions

The Federal Reserve targets a 2% inflation rate, which remains below current levels. Analysts expect policymakers to consider lowering interest rates next month. Fed Governor Christopher Waller stated he supports a cut and may back a larger move if labor data weakens.

Consumer spending rose 0.5% in July, showing resilience despite price increases. Personal income also advanced 0.4% during the same period, supporting broader demand. Energy prices fell 2.7% year-over-year, keeping headline inflation lower.

Market reactions were mixed following the release of the inflation report. U.S. stock futures traded lower, and Treasury yields stayed firm. Crypto investors reacted quickly, pulling capital from ETFs as inflation data pointed to persistent price pressures.