Chainlink price holds near $23 as $25M exits exchanges, with analysts pointing to $28 as the next key support.

Chainlink (LINK) is drawing attention as traders debate whether the token can reclaim the $28 level as support. Market analysts and on-chain data point to rising wallet activity and large exchange outflows, suggesting investors are positioning for potential volatility.

Chainlink Price Levels and Analyst Warning

Technical analyst Ali Martinez warned that LINK must regain $28 as support to avoid further losses. He noted that failure to hold above this level could expose the asset to a correction toward $16.

At present, LINK trades around $22.96, showing recovery from earlier lows but still below the mid-$20 resistance zone. The $28 mark has become a key focus, with many traders watching how LINK reacts if tested again.

The warning comes as LINK experiences choppy movements, leaving traders uncertain about its short-term direction. A rejection near $28 may fuel selling pressure, while a confirmed breakout could open the path toward higher targets.

On-Chain Wallet Growth and Exchange Outflows

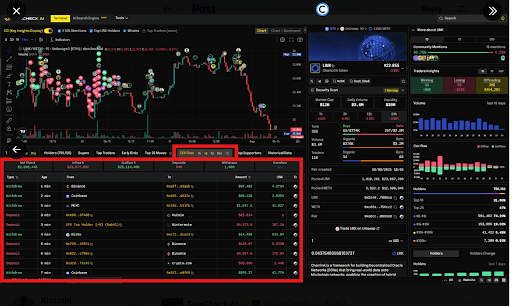

On-chain monitoring platform DexCheck AI reported strong activity from new wallets accumulating LINK during the recent price dip. According to its data, over 4,200 wallets added LINK in the past 24 hours. The total on-chain holder count now exceeds 796,000.

The same report revealed that investors are moving LINK away from centralized exchanges. More than $25 million worth of LINK was withdrawn into personal wallets, while $23 million was deposited back onto exchanges. This shift left a net outflow of $2 million from centralized platforms.

Exchange outflows are often seen as a sign of investor preference for self-custody, especially during periods of uncertain price action. The increase in wallets may also indicate a broader base of retail or mid-sized accumulation.

Market Context and What to Monitor

Analysts suggest that LINK’s performance will remain linked to overall market sentiment, especially trends in Bitcoin and Ethereum. Broader moves in these assets often set the tone for altcoins, including LINK.

If LINK successfully reclaims and holds $28 as support, traders expect a possible push toward the $30 area. A failure to do so could renew selling interest and test the $16 level, which has been flagged as a demand zone by several analysts.

Market watchers are also monitoring whale flows and liquidity changes across exchanges. Large withdrawals or deposits can quickly shift supply and demand, influencing price direction in short periods.