Pendle price breaks $5 as TVL hits $7.8B with new integrations and features driving strong liquidity and fueling a fresh DeFi rally.

Pendle’s price recently jumped above $5, signaling strong momentum for the DeFi token. The project’s total value locked (TVL) has reached record highs amid expanding user activity.

New integrations and innovative features are helping drive liquidity and attract more traders. Despite market-wide challenges, Pendle is showing resilience and growth. These developments suggest Pendle is moving beyond mere market trends to set its own pace.

Pendle Price Rally Boosted by Record TVL and Expanding Ecosystem

The price of Pendle (PENDLE) climbed to $5.40, marking a 6.4% gain in 24 hours and more than 36% over the past week. Trading volume remains healthy, with daily turnover exceeding $312 million, according to CoinGecko data.

This rally comes as the project’s TVL surged past $7.8 billion, a 56% rise in the last 30 days. Such growth indicates strong confidence from users and liquidity providers.

Pendle just flipped $5 and keeps running.$PENDLE brings real innovation to DeFi yield. You can split assets, trade future yield, and control your earnings like never before.@pendle_fi is making onchain flexibility a reality.

Real growth here. this momentum is no accident.… pic.twitter.com/WTMKFvopgP

— Rain (@raintures) August 8, 2025

Onchain activity confirms this bullish shift. HyperEVM pools alone surpassed $100 million TVL, according to crypto analyst Rain (@raintures). Meanwhile, sUSDe pools have maxed out their capacity, underscoring increased demand.

These liquidity expansions reflect deeper user engagement and capital inflow. The ecosystem’s steady growth shows the poject’s innovation is resonating with DeFi participants.

New Integrations and Features Drive Liquidity and Yield Options

Recent collaborations with protocols like Ethena and Aave are pushing Pendle’s growth further. Deep Value Memetics (@DV_Memetics) reports that PT-USDe looping on Aave brought over $3.3 billion collateral, growing the supply by $3.7 billion in just 20 days.

This loop enhances capital efficiency and yield generation opportunities for users. These partnerships add layers of utility, drawing in fresh capital and traders.

$PENDLE: TVL Hits $7.8B ATH, Boros Launches, Yield Infra Expands

– $PENDLE up +20% (24h), +32% (7d), trading at $1.5B FDV.

– TVL rose +56% in 30 days to $7.8B; 30d revenue $4.3M, annualized $52M → ≈27x FDV/fees multiple.

– Boros launched enabling onchain funding rate trading… pic.twitter.com/jUQcAUUhkb— Deep Value Memetics (@DV_Memetics) August 8, 2025

Boros, a new launch on Pendle, introduces funding rate trading for BTC and ETH perpetual markets. This feature broadens yield hunting strategies and opens access to sophisticated DeFi products.

Additionally, the protocol updated incentives, reducing swap fees and setting dynamic caps based on fee contributions. These changes aim to optimize user experience while supporting sustainable liquidity.

Euler Finance’s support for Pendle’s new PT tokens as collateral further expands borrowing options. AEON partnership also enables $PENDLE payments across over 20 million merchants globally, extending Pendle’s real-world utility.

Together, these advances signal Pendle’s move toward more comprehensive fixed yield infrastructure and institutional readiness.

Technical Signals Suggest Further Upside Potential for Pendle Price

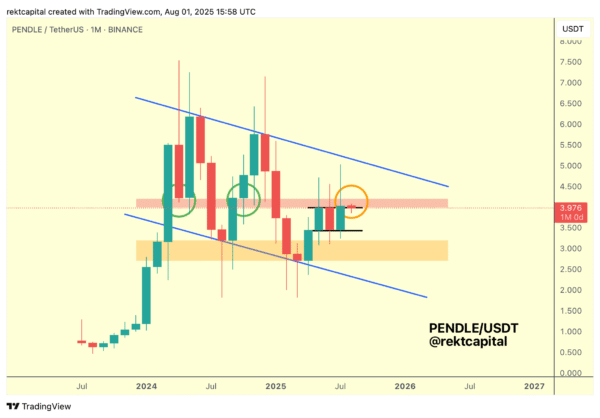

According to technical analyst Rekt Capital (@rektcapital), Pendle has confirmed a breakout from its bull flag pattern, triggering a rally above 30%. The token is now testing higher timeframe resistance within a macro wedge formation.

Maintaining this support zone will be critical for further upside.

While Bitcoin recently failed a similar retest on a weekly timeframe, Pendle’s monthly retest allows more room for volatile price moves. The analyst notes that if Pendle holds above the current red zone and turns it into support, it could advance toward the top of the macro wedge pattern.

Overall, the combination of strong technicals and expanding liquidity points to a solid foundation for the token’s rally. The token’s growing ecosystem and new features may continue attracting yield-focused crypto investors.