Pi network is facing a sharp decline, losing over 80% from its peak amid major token unlocks and collapsing trading volume. Backlash for Pi Network has intensified as a $250,000 giveaway and a Q3 wallet beta launch scheduled for September 15 shine a light on utility-focused alternatives like Remittix.

Pi Network Faces Technical Breakdown and Liquidity Crisis

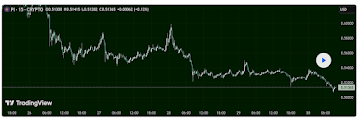

Pi network currently trades around $0.34, reflecting a steep fall from its all-time high near $3 in early 2025, a wipeout of more than 80%. Trading volume has crashed from over $3.5 billion to under $50 million, signaling a sharp erosion in market interest.

Analysts point to a descending channel pattern and RSI levels near 38, with some forecasts warning of a further drop toward $0.15 by early 2026 if fresh catalysts fail to appear. Token unlocks flooding the market, and illiquid pools make a steep collapse plausible.

Remittix Offers Structure and Utility That Pi Network Lacks

Pi network traders are facing fading fundamentals, rising supply pressure, and little exchange traction. In contrast, Remittix projects a roadmap built on deliverables rather than anticipation. It is being considered as a sound alternative among holders unsettled by Pi Network’s downward spiral.

Having sold over 647 million tokens and reached $24 million in funding, Remittix holds a price of $0.103. It first secured BitMart at the $20 million stage, later joined LBANK after $22 million, and is now working on a third exchange entry. And with the Q3 wallet beta release only days away, momentum and accessibility are on the rise. That progression outpaces Pi Network’s stagnation and speculative descent.

Here are five strong reasons RTX may be a smarter option right now:

- Wallet beta live on September 15 delivers real-world value

- Solving a real-world $19 trillion payments problem

- Direct crypto to bank transfers across 30+ countries

- Audited by CertiK to ensure trust and security

- Momentum is building ahead of its next exchange listing

Remittix caters to actual adoption and structural gains, while Pi Network grapples with technical breakdowns. That makes Remittix more compelling for anyone seeking sustainable upside and clarity, rather than hope.

Pi Network Risks and Remittix Opportunity

Pi network’s fall of over 80%, coupled with frail liquidity and high unlock pressure, opens the door to potential collapse in 2026. Forecasts warn of a drop as low as $0.15 without fresh upward catalysts.

Meanwhile, Remittix is building toward real use today, backed by strong funding, exchange access, audited security, and a wallet that delivers utility on September 15. For anyone concerned about Pi Network’s instability, Remittix offers a practical and proactive growth path that aligns far better with real-world adoption trends.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.