Polymarket targets a $12B valuation as its crypto expansion accelerates, driven by major partnerships, U.S. market re-entry, and rising global demand.

Polymarket seeks to raise funds at a $12B valuation, expanding in crypto and international markets. This is after it returned to the US and signed strategic partnerships, increasing its competition with Kalshi. According to Bloomberg, Polymarket and its competitor Kalshi are aggressively growing. This includes the crypto, blockchain, and international markets. Polymarket is looking to restart the business with clients in the UAE.

Polymarket’s Resurgence and High-Profile Connections

Meanwhile, Kalshi is using its regulatory approval in the U.S. as a leg to move into compliant trading. It currently has a valuation of $10 billion.

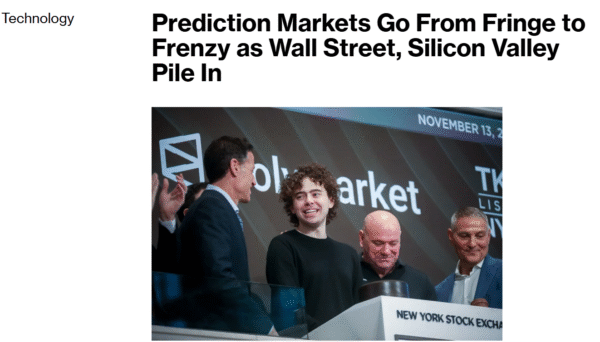

An intimate meal, 60 floors up from New York’s financial district, took place recently. It united a pillar of the Wall Street establishment and a young crypto upstart. The host was billionaire septuagenarian Jeffrey Sprecher, CEO of Intercontinental Exchange Inc. He is the owner of the New York Stock Exchange. His guest was the 27-year-old Polymarket founder Shayne Coplan.

Related Reading: Prediction Platform Polymarket Relaunches in U.S. After CFTC Fine | Live Bitcoin News

Crypto prediction market Polymarket is reportedly planning a new round of fundraising. This is on a valuation of $12 billion. This number is upwards of the previously announced $10 billion in late October 2025. This comes on the heels of Polymarket’s rapid crypto expansion. It also comes on the heels of a slew of major business developments throughout 2025.

Key developments of 2025 have been significant. The return of Polymarket to the U.S. market is very important. After being forced offshore in 2022 due to regulatory issues with the Commodity Futures Trading Commission (CFTC), Polymarket acquired a CFTC-licensed derivatives exchange, QCX, in early 2025 for $112 million. After a no-action letter from the CFTC in September 2025, Polymarket launched a U.S. beta.

Polymarket Grows With New Sports, Tech, and Finance Partnerships

Strategic partnerships have been a huge focus. Intercontinental Exchange (ICE), parent company of New York Stock Exchange, announced a massive investment. In October 2025, it would invest $2 billion at the cap of up to $2 billion in Polymarket. This was at a valuation of $8 billion to $10 billion.

Further partnerships strengthen their presence in the market. In November of 2025, Polymarket signed multi-year licensing agreements. These were with both the UFC and the National Hockey League (NHL). This opened up its territory in the American sports market.

The platform also worked with Elon Musk’s xAI in June of 2025. Its prediction results were integrated into Google in November 2025. Other partnerships are in the form of fintech platforms such as Yahoo Finance and Stocktwits. These further integrated Polymarket’s markets to traditional financial media.

Product expansion has also been key. In October of 2025, Polymarket introduced direct Bitcoin deposits. This extended its funding options beyond Ethereum-based assets. The company has also looked at launching its own token and stablecoin.

This high momentum and return to the lucrative US market position position Polymarket for its higher valuation. However, it has a lot of stiff competition, especially from its U.S.-regulated rival, Kalshi. The prediction market space is getting hot with big players.