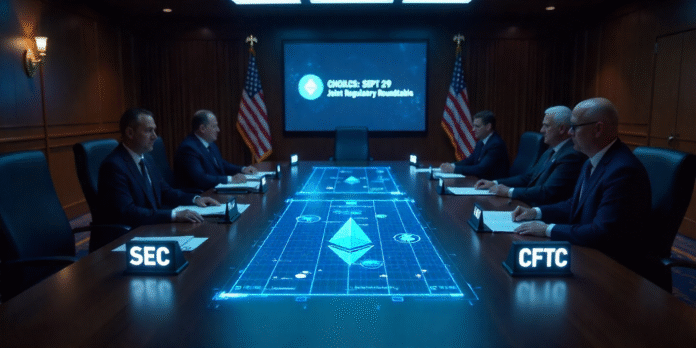

The SEC and CFTC convene a crucial roundtable on regulatory harmony on digital assets Sept. 29 to jump-start innovation and transparency.

The SEC and the Commodity Futures Trading Commission (CFTC) are doing everything to align their jurisdiction to control digital assets.

On September 5, 2025, the two agencies announced that they would organize a joint roundtable on September 29 to discuss opportunities to harmonize regulations in digital asset markets.

This is a clear shift to teamwork after many decades of incoherent organization and duplication of control. The two regulators emphasized that they would use their existing powers to simplify regulations, reduce market uncertainties, and promote innovation.

The Game-Changing Roundtable: What to Expect, inside

The next roundtable, which will be open and available on the web, will take place at the SEC headquarters in Washington, D.C., between 1 p.m. and 5 p.m.

The focus of the discussion will be on product-venue congruency and standardization of reporting and data requirements, and possibly on congruent innovation exemptions to empower market participants.

This represents only the initial step in a protracted process to bring the market the clarity it warrants, according to SEC Chairman Paul S. Atkins and CFTC Acting Chairman Caroline D. Pham.

They said harmonized frameworks could simplify capital and margin regulations to eliminate inefficiencies and create a competitive market in the U.S.

They are also working together to regain leadership in digital financial innovation by promoting new products to stay on American soil instead of crossing borders to foreign lands because of lax regulations.

Key Areas in Focus: Crypto, DeFi, and 24/7 Markets

The topics that will be discussed in the round table include spot crypto asset regulation, decentralized finance (DeFi), prediction markets, perpetual contracts, and portfolio margining across agencies.

Both the SEC and CFTC are interested in wider financial market innovations, such as the possibility of 24/7 trading in traditional securities.

They also reiterated the need to prioritize the protection of investors and support the development of a transparent and efficient framework to promote the growth of the digital asset market with less regulatory fragmentation.

This is a historic turning point that heralds collaboration between two influential market watchdogs. Cooperation between the SEC and CFTC is an effort to streamline regulatory processes, cut down on unnecessary red tape, and strengthen the United States’ position as a global leader in financial markets and technological innovation.