Solana consolidation nears 18 months as traders monitor $210 resistance for a possible next move.

Solana has held above the $200 level in recent sessions, attracting attention from traders and analysts who are closely monitoring its next move. The token has been consolidating within a clear range, and price movements suggest that momentum may be building toward a breakout.

Solana Price Action Around Key Levels

Solana is trading near $203 after rebounding from the $190 area earlier this week. The recovery has kept the token inside an ascending wedge pattern, with resistance near $215 and support close to $182. Analysts point out that the $197 to $194 zone now acts as the first line of support, while the 100-day EMA around $190 has repeatedly provided stability.

Traders are focused on the $210-$215 resistance zone, which has blocked further progress in recent attempts. A sustained move above that level could create room for a push toward $225. If Solana falls below $182, the wedge structure may weaken, opening the way to $170.

Altcoin Sherpa noted on X that Solana’s strength at these levels is unusual. He added that those holding from lower entries may consider profit-taking between $205 and $215. Chris Burniske also noted that Solana has been consolidating for almost 18 months, raising interest about what could happen next.

Technical Indicators and Market Momentum

Technical indicators suggest that Solana remains in a favorable position. The relative strength index is around 60 after recovering from lower levels last week. Rising RSI lows since mid-August point to consistent demand, and bullish control is expected to hold as long as readings remain above 55. A reversal below 45 would indicate weakening momentum.

Short-term moving averages also support the trend. The 20-day EMA is positioned near 197 dollars, and the 50-day EMA is close to 194 dollars. Both levels are being used by traders as immediate support zones. The longer-term moving averages at 190 and 184 dollars continue to protect against deeper declines. This alignment has kept buyers active during recent retracements.

Liquidity data shows renewed interest from investors. Net inflows of 10.76 million dollars were recorded on August 27, marking a shift after months of outflows. Historically, such inflow spikes have aligned with short-term rallies, and the ability of price to remain above 200 dollars supports the case for ongoing demand.

Expanding Role of Solana in DeFi

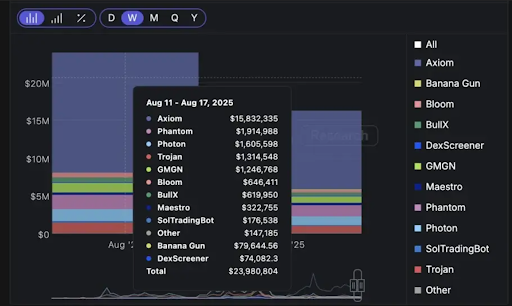

Alongside market activity, the Solana ecosystem has seen stronger performance from decentralized exchanges. Axiom Exchange has recently led the network’s DEX platforms, recording 15 million dollars in weekly revenue. This figure places Axiom at the top of Solana-based exchanges while several others also achieved earnings above 1 million dollars in the same period.

Reports indicate that ten platforms on the network generated over $75,000 weekly, a level that can sustain small development teams. The growth of these exchanges reflects the rising utility of Solana for decentralized finance, supported by its ability to process up to 65,000 transactions per second with low fees.

This environment has made Solana an attractive option for both institutional and retail users who require low-cost and fast settlement. Strong liquidity combined with reduced transaction latency has continued to position the network as a central hub for trading activity.