With strong institutional buys and bullish signals, Solana can decline to below 160. Take into account the risks and the major factors that determine its price prognosis.

Solana (SOL) is priced at around $204 but the technical analysis indicates that the currency is likely to fall to $160. Ali Charts on X shows the digital asset developing a rising wedge trend, which is usually an indication of bearish pullbacks.

Source X

The tendency suggests that the price could reach approximately $160 even though the market has been hopeful.

HUGE Capital Rush Increases FancyA

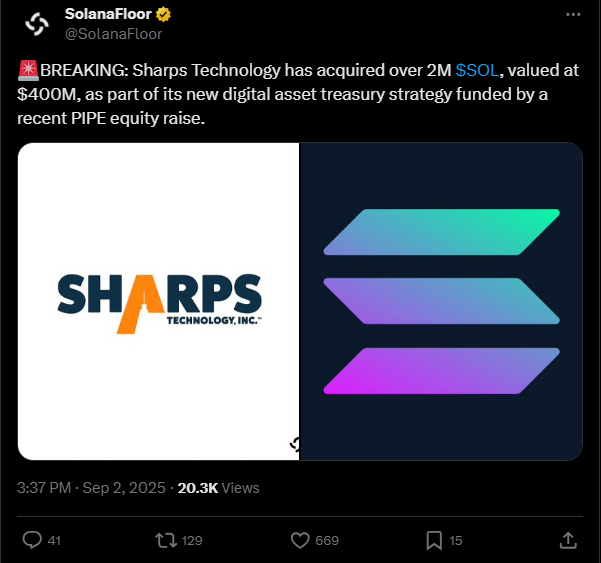

There is much institutional interest in Solana. According to Sharps Technology, which just added $400 million of capital to create one of the largest Solana treasuries, there is a lot of optimism around the future of SOL.

Source – X

They plan to purchase more than 2 million SOL tokens, which will be financed via a private equity raise. The approach by Sharps points out the speed, scalability, and expanding institutional adoption by Solana.

The Galaxy Digital, Jump Crypto, and Multi-coin Capital also intend to raise 1billion of SOL to form an even larger treasury fund.

Their migration demonstrates high-stakes returns and the development of the ecosystem. Such changes generate strong buying pressure on Solana and generate a wave of bullishness among traders and investors.

Why the Risk of a Pullback?

Irrespective of the positive fundamentals, the increasing wedge pattern signals an imminent correction in the price.

This chart pattern is common with a negative trend that follows a slowing of buyers’ movement and the domination of sellers. Solana may reverse its present price around 200 to areas around 160.

The most recent price movement indicates stagnation and resistance on the price fronts of 203 and 204. Unless the Solana breaks above these resistance areas, decisively, right above the wedge, it may end up in the downside target of the wedge. To indicate this shift, traders pay attention to volume and momentum indicators.

The Trade-Off of Bullish Signals Versus Technical Risk

The institutional treasury purchases and staking rewards are an indication that Solana has bullish prospects.

Nevertheless, analytical graphs indicate a distinct scenario that is about to draw back from its current position.

Such a dichotomy results in uncertainty and instability in the market. Investors ought to observe that the acquisition of treasury by large volumes usually causes the support of prices, but fails to ensure continuous upward patterns.

The ultimate price action will be based on whether Solana can escape the rising wedge trend and collect some consistent bullish forces. Up to this point, the threat of a downward adjustment towards $160 is a huge consideration.