SEC has 32 days left to rule on Solana Spot ETF, which is to be issued on October 10, as corporate SOL holdings continue to grow and the market awaits it.

Solana Spot ETF applications are due to be ruled by the SEC by October 10, which is only 32 days away.

This last deadline is a decisive point of the chances of the ETF approval by Solana, which provokes intense interest in the market.

Source – X

This is unchangeable, according to an announcement made by SolanaFloor on X, which is only deepening the interest of both investors and crypto enthusiasts.

In addition to filings, the longer look-through of the SEC may be indicative of a green light in the near future.

An optimistic regulatory climate in the cryptocurrency industry is expected to allow for permits to be completed by the middle of October, according to estimates.

The SEC is also cautious, as the issuers have to amend in line with the cautious approach the SEC takes. Highlighting the importance of careful vetting of staking and redemption mechanisms in the proposed ETFs.

Corporate Giants Boost Solana Holdings, Fueling Growth Potential

Source – X

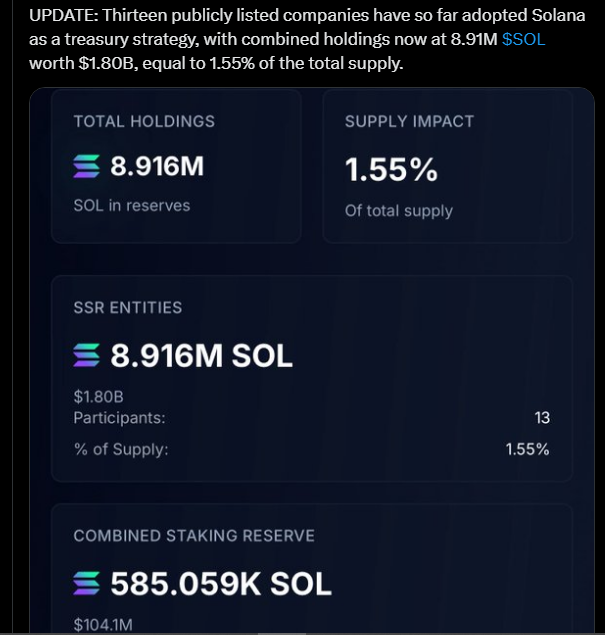

There are now thirteen publicly listed companies that hold an estimated 8.9 million SOL tokens. These are equivalent to roughly 1.80 billion, which is 1.55 percent of the total supply in circulation at Solana.

Upexi Inc., which owns 2 million SOL, and DeFi Development Corp., which has a close quantity of approximately 2 million SOL, are the two companies that hold the most SOL comparatively.

Such a strategic adoption strengthens the market of Solana since their corporate treasuries are proactively utilizing Solana not only as an investment tool but also as a staking yield tool.

These reserves have approximately 585,000 SOL staked, giving an average yield of nearly 6.86, and the treasury assets are not lying dormant.

The large accumulation of corporate treasuries is an indicator of rising confidence in the potential of Solana and its innovativeness.

This institutional factor creates a drive in the run-up to the SEC ETF decision, which suggests that long-term value prospects are perceived by public companies.