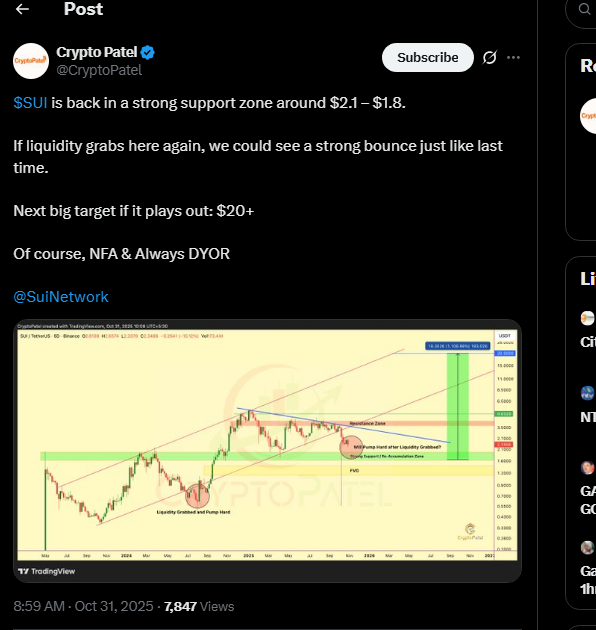

SUI is trading within the support range of 2.10-1.80 historically, which has drawn liquidity and a high chance of rebounding, because of previous performance and due to activities on the chain.

SUI has returned to the critical support zone of $2.10 to 1.80, which has been shown to attract liquidity and initiate sharp price rises.

Market trends suggest that this region may be a turning point in future course changes.

Source- X

Liquidity Zones and Price Dynamics Spark Interest

As per the chart, SUI has continued to follow an upward trend since the middle of the year 2024; a recent pushback off of 4.83 has settled around 2.17.

It is a re-accumulation region where the liquidity has historically concentrated to allow rebounds in prices.

Trading volume remains constant, supporting a framework that has greater lows in the lower part of the channel. The analysts indicate that previous liquidity grabs in this zone have yielded high returns.

It pays close attention to the internal range and price action in the range and seeks the occurrence of a breakout; a rebound to resistance around $4.83 can be used to create additional upside.

The dynamic of price movements around the POC zone can help understand the near-term position of SUI.

On-Chain Data Confirms Ecosystem Strength

The ecosystem has a stable liquidity, partly due to the approximate capitalization of the stablecoin at around $933millions, which promotes the DeFi on the Sui protocols.

Active user participation and continuous derivative trading contribute to the daily chain fee and revenues of the app.