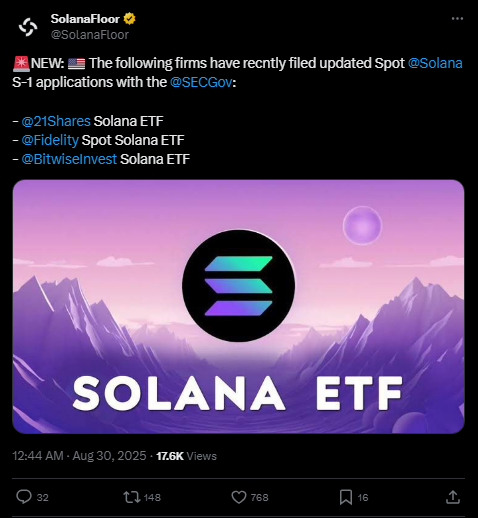

Major ETF providers have refiled Solana-based Spot ETF applications with the SEC, hinting at ETF market expansion.

Leading fund providers and asset managers, 21Shares, Fidelity, and Bitwise, have submitted updated Spot Solana ETF applications to the United States Securities and Exchange Commission (SEC).

This represents another major milestone in the ongoing pursuit by various projects indexed to the Solana blockchain of launching a Solana-based exchange-traded fund (ETF).

Source – X

According to the SolanaFloor account on X recently, these firms have submitted their updated Spot Solana ETF S-1 documents under revised terms to the SEC.

These developments are rooted in earlier filings, a testament to the surging institutional interest within Solana’s blockchain ecosystem.

With Solana in ETFs, Market Rebound Capabilities Restored

The new filings by 21Shares, Fidelity, and Bitwise come as market attention on cryptocurrency ETFs is at an all-time high. With its fast and low-fee transactions, Solana profiles as an attractive member of the list of ETF-tracked tokens.

The integration signifies the platform’s development as a pioneer of exchange-traded funds (ETFs), an investment instrument that leverages cryptocurrencies, positioning 21Shares as a driving force in the crypto ecosystem.

Fidelity’s Spot Solana ETF filing adds to its digital asset product offerings, and bitwise doubles down on its crypto ETF aspirations. These directives underpin an emerging view of Solana as an increasingly marketable product.

Archives of SEC filings and filings submitted to official public record (Source A, B, and C) – confirm that these filings were received in official public records.

The importance of the announcement of these new Spot Solana ETF proposals is that the ball is now in the SEC’s court to take action to also review these products as ETFs, in the face of regulatory scrutiny.

What This Mean for Crypto Investors

The Spot Solana ETFs could unlock long-term access to Solana for more investors without requiring them to own specific cryptocurrencies.

Experts have claimed that the approval of these ETFs will increase the demand for Solana and lead the way for more altcoin ETFs ultimately.

Accounting paperwork: the filings highlight the growing institutional demand for diversified crypto products within regulated frameworks.

As 21Shares, Fidelity, and Bitwise pave their crypto way through the securities filings, the globe is holding its breath as typical methods of investing elbow one side to the contrary. Solana’s proof-of-stake technology poises its ecosystem on the brink of mainstream adoption.