The famous OG Bitcoin whale recently moved $435 million into Ethereum and has raised its ETH holdings to $3.8 billion. What does this Bitcoin rotation trend mean?

A long-time Bitcoin whale has made a major move into Ethereum. The mysterious whale, who is often referred to as a “Bitcoin OG,” has been slowly rotating part of its $11.4 billion Bitcoin fortune into Ether since late August.

Ethereum Gains Momentum in Whale Portfolios

Over the weekend, blockchain data shows that the whale sold 4,000 Bitcoin worth around $435 million and exchanged it for 96,859 Ethereum.

The move increased the whale’s total Ethereum holdings to $3.8 billion, and on Monday, this wallet deposited another 1,000 Bitcoin into Hyperliquid.

This Bitcoin OG has sold 4,000 $BTC($435M) and bought 96,859 $ETH ($433M) spot over the past 12 hours.

In total, he has bought 837,429 $ETH($3.85B).https://t.co/RAEzClsCvr pic.twitter.com/ZUSDL1cIRm

— Lookonchain (@lookonchain) August 31, 2025

The whale’s pivot toward Ethereum shows a trend seen among other large holders. Separately in late August, another group of nine whale addresses collectively bought $456 million worth of Ether, according to Arkham data.

Ethereum reached an all-time high of $4,946 on August 24, according to CoinGecko. It is currently trading near $4,389 and is showing steady interest despite market corrections.

Ethereum as a Core Asset

The Ethereum accumulation from the whales shows that digital assets have matured beyond a single dominant coin. Bitcoin still serves as a store of value, but Ethereum offers defi functionality and yield that appeals to institutional investors.

Just as regulatory clarity increases and Ethereum’s reach expands, analysts expect more large players to balance their portfolios with both assets. This trend indicates that the crypto market is no longer defined solely by Bitcoin.

Instead, it is controlled by a mix of assets that play differing roles.

Ethereum is moving from being a secondary option to a core asset in whale portfolios, thanks to staking and smart contracts.

The GENIUS Act has given Ethereum and other altcoins a stronger regulatory footing, which has boosted confidence among large investors.

In all, crypto investors are no longer focusing only on Bitcoin. Whales are adopting strategies that spread risk and capture opportunities across multiple assets.

Institutions Continue To Buy BTC

While certain whales continue to sell their Bitcoin for Ethereum, institutions like MicroStrategy (now Strategy) and MetaPlanet continue to load up on the flagship crypto asset.

Strategy, for example, bought 3,511 BTC in August. Bitcoin traded at an average price of $116,000 in August, which means that the Strategy’s total Bitcoin purchase for the month sat at around $407.2 million.

Additionally, Japanese investment company Metaplanet also added more bitcoin to its holdings and scooped up a staggering 1,859 BTC. This means that, similar to MicroStrategy’s average purchase price of $116,000, Metaplanet spent just over $215.6 million on Bitcoin during the month.

Ethereum Holds Dominance On Stablecoin Flows

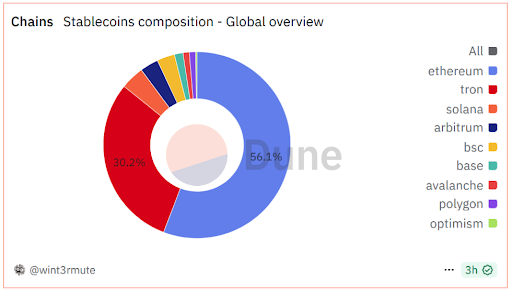

According to DefiLlama, the stablecoin market cap has been on the rise lately. This metric has hit a high of nearly $300 billion since the beginning of the 2023–2026 cycle. Speculators continue to predict that this amount will break above $400 billion by the end of the year and rise to the trillions over the next few years.

This comes alongside the recent passage of the GENIUS Act in the United States, and has seen Stablecoins, which were formerly fringe assets, becoming a direct rival to established money-transfer networks like Visa.

Dune Analytics data shows that Ethereum powers 56.1% of all stablecoins, which has been another major source of its strength lately.