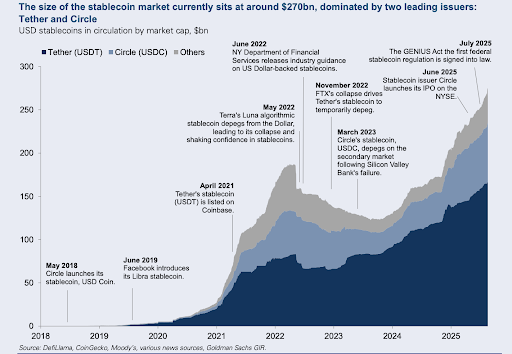

Goldman Sachs recently predicted the stablecoin market will grow from $271B to trillions in a few years. What drives this change?

Goldman Sachs has predicted that the total stablecoin market could expand from its current $271 billion value into the trillions within the next few years. The investment bank expects payments, decentralised finance (DeFi) and cross-border transactions to be the biggest drivers of this growth.

Visa, as well, estimates that annual payments around the world are currently about $240 trillion. This means that as stablecoins are now backed by regulation and institutional use, they could more readily tap into this massive sector.

Goldman Sachs’ Research on Stablecoin Growth

The bank released its research paper titled Stablecoin Summer, where it predicted a strong rise in stablecoin adoption. Analyst Will Nance and his team expect Circle’s USDC to grow by $77 billion over the next two years.

This represents a compound annual growth rate of about 40%.

The report notes that most stablecoin activity today is tied to crypto trading and non-U.S. demand for dollar exposure. However, Goldman Sachs believes the payments industry will unlock the real power of stablecoins. As regulatory clarity continues to emerge, mainstream adoption could be on the rise rapidly.

Regulatory Shifts and the GENIUS Act

A major driver for this forecast is the GENIUS Act, which was passed in July. The law requires all stablecoins issued in the U.S. to be backed 1:1 by Treasury bills or equivalent reserves.

✅ GENIUS ACT SIGNED INTO LAW

"The GENIUS Act creates a clear and simple regulatory framework to establish & unleash the immense promise of dollar-backed stablecoins. This could be perhaps the GREATEST revolution in financial technology since the birth of the internet itself." pic.twitter.com/CH5pnznAuf

— The White House (@WhiteHouse) July 18, 2025

Treasury Secretary Scott Bessent has also argued that these rules will strengthen the dollar and expand the worldwide demand for U.S. Treasuries. He indicated that the stablecoin market could break above $2 trillion if adoption continues at its current pace.

This regulatory clarity provides a strong foundation for institutions and businesses to engage with stablecoins. Unlike in previous years, issuers now have clear rules for compliance, reserve management and reporting.

Circle and the Battle for Stablecoin Leadership

Circle, the issuer of USDC, is well set up to benefit under the new U.S. framework.

Goldman Sachs believes USDC to be one of the best-regulated options that can serve as a digital dollar in payments and finance.

Circle’s stock, which is listed under CRCL, has seen major volatility lately. It recently hit a peak at $263 in June before falling to around $138 by late August. Despite the swings, the company is moving ahead with its mission in digital payments.

Circle is facing competition from Tether, the issuer of USDT, though. Tether has not allowed U.S. citizens to use its product, but CEO Paolo Ardoino has indicated that plans are underway for entry into the American market.

Large U.S. banks are also preparing to issue dollar-pegged tokens. Mizuho Securities recently warned that firms like Bank of America could create new rivals in the stablecoin space.

Institutional Adoption Strengthens

Goldman Sachs pointed out that institutions are already moving into stablecoin-linked finance. BlackRock, Franklin Templeton and BNY Mellon, for example, are tokenising money market funds. They are also linking them with stablecoin rails to speed up settlements.

These moves indicate that Wall Street sees stablecoins as a tool to modernise finance, and Goldman’s research shows that traditional firms are unlikely to resist. Instead, they may adapt stablecoin technology into their operations as the years go by.