- The order issued by Trump prohibits discrimination in banking on the grounds of beliefs.

- Banks must reinstate unfairly dismissed clients due to politics.

- Regulators are to do away with discriminatory regulations, such as reputation risk.

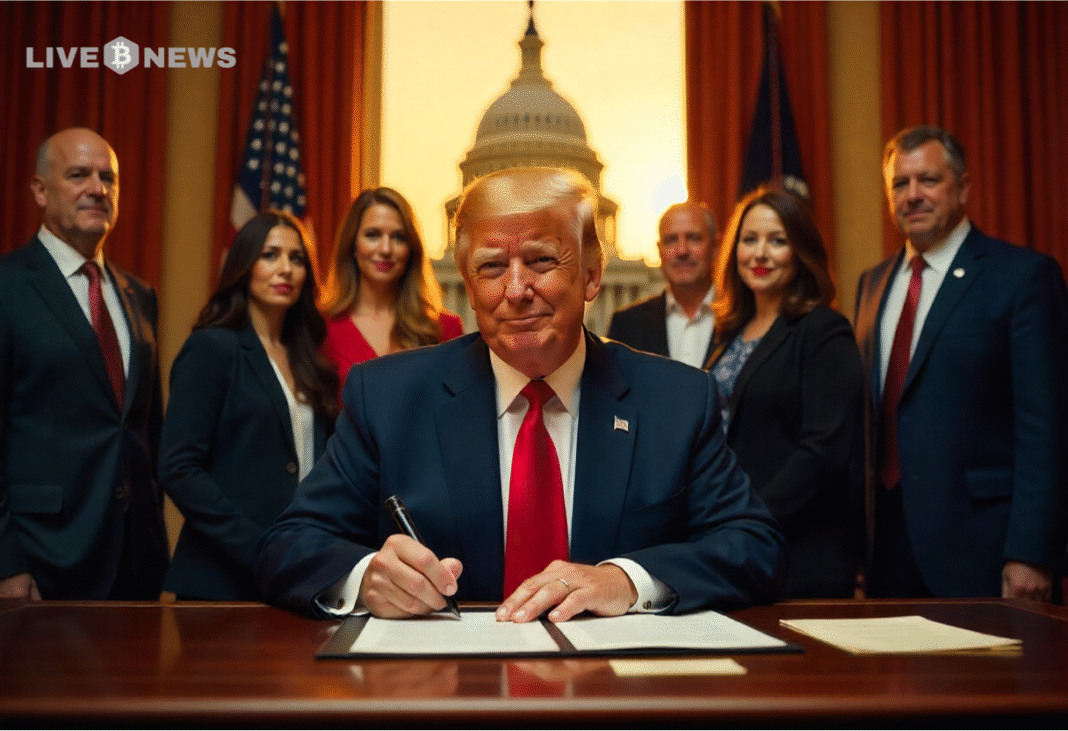

Financial discrimination in banking meets its match. A bill to ensure fair banking practices for all Americans was signed into law by President Trump. This executive order goes after prejudice in the financial services. It prevents the banks and regulators from refusing services on political or religious grounds.

Many Americans suffered blocked accounts and frozen payrolls. They had committed no crime but proper business or ideas that did not agree with the regulators. This new act targets those unfair barriers directly.

Unmasking the Banking Bias: What You Need to Know

Banks and regulators had already put people on notice over purchases in relation to certain firms or keywords such as Trump or MAGA. This happened without proof of wrongdoing.

Investigations such as the “Operation Chokepoint” as well as banks were arm-twisted into divesting politically unpopular, but otherwise legal, businesses. This hard practice added pain to families and businesses economically and reputationally.

The order issued by Trump requires the banking decisions to be made based solely on risk-based principles, which are measurable. It does not permit refusal of services on religious or political grounds.

The Small Business Administration should inform the banks in order to detect politicized debanking and reverse it. These customers will be restored, giving notice to those who are affected.

Concrete Steps to Clear the Financial Fog

In 180 days, federal banking regulators will purge their regulatory manuals of biased terms such as reputation risk. These terms allowed discrimination disguised as risk management. The decisions that are made by banks should be objective and devoid of politics.

An initiative devised by the Treasury will be used to come up with additional measures that are used in the process of eradicating illegal debanking. Banks that have practiced bias in the past are also in need of review and penalty.

Source – whitehouse.gov

Stricter penalties will be imposed for violations of the Equal Monetary Opportunity Act. Religious discrimination in banking will be deemed to merit civil action in case of non-compliance is not met.

This executive order confronts politicized financial exclusion head-on. It protects the right of Americans to obtain banking that is not biased by politics or religion.

The act reinstates the fact that financial services should be founded on equity, equal access, and trust. These rules restore confidence in our nation’s banking institutions. The order provides a clear limit to a politicized regulatory state from weaponizing governmental power.

The action taken by President Trump guarantees that banking is a matter of business and risk rather than belief. It promises to safeguard basic rights in the financial sector for every American.