Key insights:

- Trump signs the GENIUS Act, the first U.S. law regulating stablecoins, allowing banks and fintechs to issue them.

- GENIUS Act mandates 1:1 reserve backing for stablecoins and monthly public disclosures to boost consumer trust.

- Critics warn the law could let corporations issue stablecoins, risking U.S. dollar stability and fueling inflation.

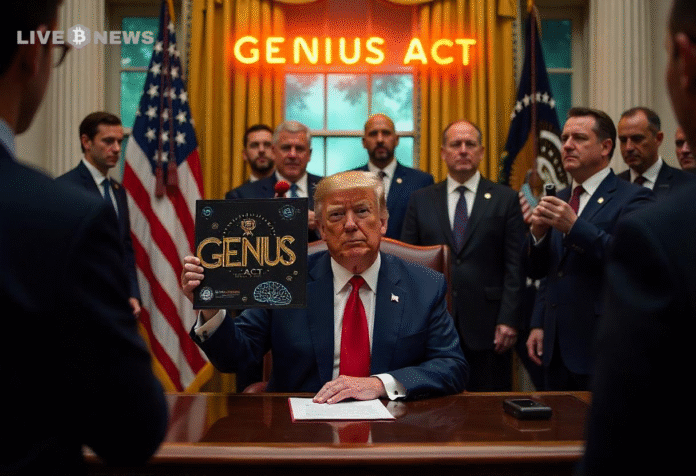

President Donald Trump has signed the GENIUS Act into law. This marks the first major piece of U.S. law aimed at regulating stablecoin. This move caps what the administration dubbed “Crypto Week” in Washington, and is seen by industry leaders as a major win for digital assets.

This is what all of this means for you as an investor.

What Is the GENIUS Act?

The GENIUS Act is short for Guiding and Establishing National Innovation for U.S. Stablecoins. It was put in place to create a regulatory framework, specifically for stablecoins.

This means that under the law, banks, credit unions and non-bank institutions are now authorized to issue stablecoins. The goal of this new law is to make digital finance easier and more secure for everyone.

✅ GENIUS ACT SIGNED INTO LAW

"The GENIUS Act creates a clear and simple regulatory framework to establish & unleash the immense promise of dollar-backed stablecoins. This could be perhaps the GREATEST revolution in financial technology since the birth of the internet itself." pic.twitter.com/CH5pnznAuf

— The White House (@WhiteHouse) July 18, 2025

Senator Bill Hagerty, one of the biggest sponsors of the bill, pointed out that stablecoins could improve US payments by allowing near-instant settlement times.

Trump echoed this sentiment, calling it “perhaps the greatest revolution in financial technology since the birth of the Internet.”

Two More Bills in Play

The GENIUS Act is only one part of three separate legislative pushes. Two other crypto-focused bills passed the House during “Crypto Week”, including the CLARITY Act, which seeks to make laws clearer for digital assets beyond stablecoins.

Finally, the Anti-CBDC surveillance state Act was also passed, and is aimed at preventing the Federal Reserve from issuing a retail CBDC directly to Americans.

While the Senate has yet to vote on these, their House passage shows that the US government’s approach to digital assets is getting better, and is leaning more towards innovation.

Should You Be Worried About This Bill?

Executives from crypto firms like Robinhood, Tether, Gemini and World Liberty Financial were present at the White House ceremony.

While the event passed with much fanfare, critics have pointed out that the GENIUS Act is leaving too many questions unanswered. The Democrats in particular, pointed out that the new law could create a situation where large corporations start to issue their own private stablecoins.

In some cases, this could undermine the US dollar and its financial stability.

If the US dollar does weaken because of this new bill, imports will skyrocket in price for U.S. consumers and businesses. Production costs for companies that rely on international suppliers could skyrocket, and squeeze profit margins.

As import costs rise, businesses may pass these expenses on to consumers in the form of higher prices. Goods will become more expensive, and inflation will start to take hold.

Why The Genius Act Could Be A Good Thing

Amid all the fears, it is clear that the GENIUS act will bring in much more regulatory clarity.

For years, the lack of clear guidelines for the crypto space has created an uncertain environment for businesses and investors alike. Besides, it has hindered innovation and stunted the adoption of stablecoins.

However, by defining who can issue stablecoins, the types of reserves required and the transparency obligations, the Act provides a much-needed roadmap for the industry.

Specifically, the law mandates 1:1 reserves for stablecoins.

When combined with the requirements for monthly public disclosures from issuers, consumer confidence is expected to skyrocket.

In addition, the Act has provisions for anti-money laundering (AML) programs and increased coordination with the Treasury Department. Money laundering cases are expected to dwindle, and the US is expected to become a leader in the stablecoin revolution.

While the GENIUS act has its downsides, it could do much to strengthen the US dollar’s reserve currency status. Moreover, it could usher in a new world for stable and non-stable digital assets.