Bitcoin price dropped to a three-week low of $114,250 as Trump’s tariff order triggered sell-offs. Despite this, institutional inflows show that there is still some long-term strength.

Bitcoin price dipped below $115,000 on Friday, hitting a three-week low of $114,250 on Coinbase. The fall in prices came after U.S. President Donald Trump announced new tariffs targeting several countries.

Bitcoin Price Tumbles After Tariff Shock

Bitcoin’s price had been range-bound between $115,000 and $121,000 for much of July. However, Trump’s executive order on tariffs broke that pattern.

TradingView data shows that Bitcoin fell 2.6% in early Friday trading in Asia, which is a slide that puts it around 6.5% below its July 14 all-time high of $122,800.

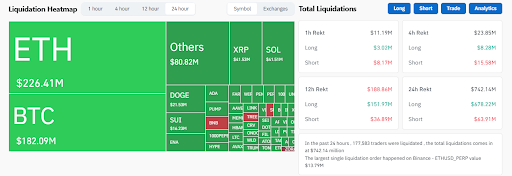

Over the past 12 hours, $110 billion left the crypto spot markets. This outflow triggered massive liquidations, and according to CoinGlass, 158,000 traders lost a combined $630 million in 24 hours, mostly long positions that expected the price to go up.

Fed Policy Adds to Market Caution

Another reason for the Bitcoin price dip is the U.S. Federal Reserve’s recent policy update. The Fed held off on interest rate cuts, which damaged market hopes for easier monetary conditions.

This cautious tone added pressure on risk assets. For example, Bitcoin, which is often viewed as a high-risk investment, was hit hard.

ETF market reacts to the ongoing Trump tariff announcements | Farside Investors

The ETF market wasn’t left out either, with outflows of up to $140 million on 31 August. This indicates that institutional investors are recalculating their positions before reentering the market.

Overall, the next few weeks will determine what comes next for Bitcoin, especially as it attempts to reclaim the $115 price level.

What To Expect From The Crypto Market

According to data from TradingView, Bitcoin is under pressure from both sides of the market. Liquidity flows show that long positions could be wiped out below $115,000. At the same time, strong sell walls around $121,100 are also capping any upward moves.

There are also buy orders stacking up near $111,000, which may provide the next major support zone.

In all, the charts show that Bitcoin could likely test the $111,000 zone before any chance of a recovery towards the upside.

In all, while short-term sentiment looks shaky, some investors are still optimistic.

Bitcoin closed July with its highest monthly candle on record at $115,784, even after the late dip.

Overall, crypto communities are divided over what’s next for Bitcoin. Some traders see the dip as a typical “shakeout” before another leg up. Others joke about “paper-handed investors” or blame it on market mechanics.

For now, the data indicates that this is a correction rather than a full reversal. Support remains strong at $111,000, and demand from institutions is still rising.

In all, while short-term traders are currently nursing their wounds, the general outlook might still favor the bulls. The ongoing high ETF inflows, corporate buying, and strong monthly closes show that there is some underlying strength at play.

Investors are now watching for signs of recovery or further downside, as Bitcoin tests its key support levels heading into August.