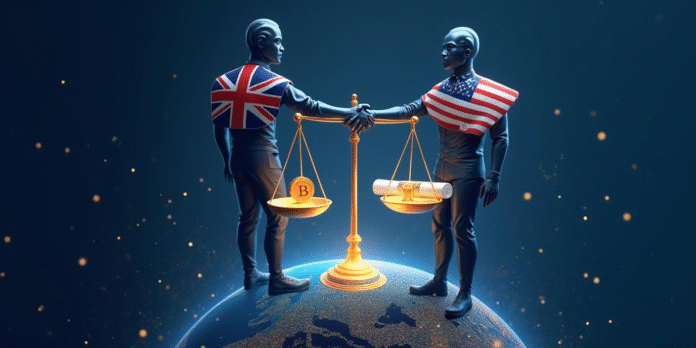

The UK and US launch a joint task force to align crypto regulations, focusing on stablecoins, AML standards, and digital asset collaboration.

The UK and the US have unveiled a new task force aimed at enhancing collaboration on crypto regulation. This task force, known as the “Taskforce for Markets of the Future,” is set to align regulations on capital markets and digital assets.

Both countries aim at strengthening their leadership in the global digital finance sector while ensuring that crypto assets are properly regulated.

Focus on Stablecoins and Anti-Money Laundering Standards

According to a Bloomberg report, the UK-US task force will primarily focus on creating a framework for regulating stablecoins and implementing anti-money laundering (AML) standards for crypto firms.

Stablecoins, being a critical element of the crypto ecosystem, require clearer regulations to ensure stability and security within the market. Both countries aim to harmonize these regulations, which will improve the confidence of investors and market participants.

This joint effort also aims to create regulatory clarity on other digital asset-related issues. By aligning their approaches, the UK and US seek to enhance market efficiency, reduce regulatory fragmentation, and foster more cross-border investments in the crypto sector.

Task Force to Explore Digital Securities Sandboxes

The task force will also explore the creation of digital securities sandboxes. This will allow testing of blockchain-based solutions across borders.

These sandboxes will enable firms to experiment with innovative digital asset technologies in a controlled, regulated environment. The initiative will be instrumental in driving the adoption of blockchain solutions for capital-raising efforts while ensuring regulatory compliance.

The task force’s work will be led by both the UK Treasury and the US Treasury. The group is to submit its recommendations within 180 days, providing a roadmap for more cohesive regulation of the digital asset space.

This collaboration will facilitate smoother interactions between the two countries’ markets, enhancing their global competitiveness in the digital finance sector.

Industry Reactions and the UK’s Regulatory Challenges

While the US has been proactive in its approach to crypto regulation, the UK has faced criticism for its slower pace in establishing clear regulations for digital assets. Industry executives in the UK have voiced concerns that the lack of clarity is hindering the growth of the crypto industry.

Many believe that the UK needs to modernize its regulatory framework to keep up with the rapid developments in the crypto space.

UK crypto industry leaders have welcomed the formation of the task force, viewing it as a positive step toward regulatory clarity. George Osborne, advisor to Coinbase, warned that the UK could fall behind in the crypto revolution unless it adapts its regulatory approach.

The UK Cryptoasset Business Council also expressed support, calling the task force a “vote of confidence” in the UK’s economy and its potential to become a leading hub for digital assets.

The creation of the UK-US crypto task force signals a renewed effort to align regulatory frameworks and ensure the growth of a stable, secure, and globally competitive crypto market.