Here’s a look at whether the United States could realistically control 40% of all Bitcoin by 2025, based on current data and trends.

A recent chart shared on social media caused a heated debate earlier this week on 5 August. According to the chart, the United States is expected to hold 40% of the total Bitcoin supply by the end of the year.

But is that possible?

While the U.S. does lead the world in BTC holdings, verified data shows that the numbers behind this claim don’t quite add up.

U.S. Bitcoin Holdings: What’s the Real Picture?

The claim that the U.S. might hold 7.8 million BTC by the end of the year is a very big one. For starters, that would mean that the country controls almost half of all Bitcoin in circulation.

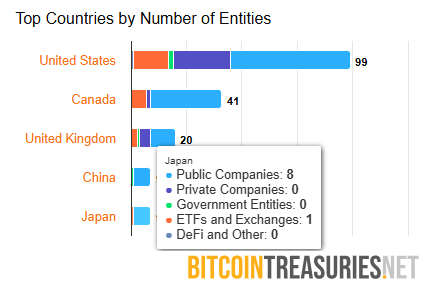

However, according to BitcoinTreasuries.net and other sources, the US holds nowhere near this figure.

For starters, the U.S. Government itself holds 198,022 BTC, most of which came from major seizures like Silk Road and Bitfinex. On the other hand, public Companies like MicroStrategy and MARA hold around 876,517 BTC.

Interestingly, MicroStrategy alone leads with over 600,000 BTC.

Private companies hold around 188,105 BTC, while the ETFs collectively hold 1,342,715 BTC.

The ETFs, in particular, are growing fast and have seen $6 billion in net inflows in July alone.

Overall, the U.S. holds about 2.6 million BTC, which is roughly 13% of the current circulating supply. Not 8 million, or 40%.

Where the 40% Claim Came From

The chart that caused the rift was posted by investor Fred Krueger, who posted the chart on X (formerly Twitter) and claimed that the U.S. could reach 8 million BTC ownership by the end of the year.

He wrote, “Bitcoin is mainly a U.S. thing,” indicating that India comes next while Europe lags far behind.

Who owns Bitcoin?

1/ Bitcoin is mainly a US thing

2/ India is the surprise number 2

3/ Europe is really not involved. pic.twitter.com/zhiZ21i7HQ— Fred Krueger (@dotkrueger) August 3, 2025

What about American retail investors, though? Could their holdings push the US’s control of the asset to the mentioned 8 million mark?

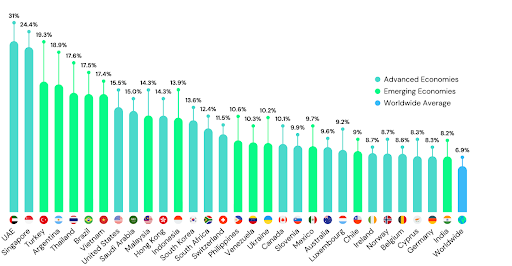

For starters, data from Triple-A shows that only around 15.5% of Americans own crypto, with Bitcoin as the top choice. This means that nearly 46 million people hold crypto.

However, most retail investors own small amounts of the cryptocurrency. This is important because retail behaviour doesn’t translate into large national BTC stockpiles.

While interest is high among American retailers, actual accumulation is relatively weak.

India’s Rising Bitcoin Demand

India is gaining attention as a crypto hub. According to sources, India is second only to the U.S. in total BTC held, with estimates around 1 million BTC (or 5% of global supply).

More interestingly, Crypto use in India has grown nearly 100% CAGR from 2018 to 2023. In addition, most holders are retail investors with small balances.

Despite this, Indians still have to contend with issues like regulatory barriers, taxes and a lack of clear guidelines.

While India’s population and adoption rates are high, the country owning $120 billion worth of Bitcoin still seems unlikely under current conditions.

Europe, China, and the Rest of the World

Outside of the U.S. and India, Bitcoin ownership is more distributed and much smaller:

Europe holds about 900,000 BTC ( or around 4.6%), which is held by both institutions and individual investors.

China holds 194,000 BTC (or around 1%), with most of this being mainly government-held after criminal seizures. Latin America and Asia (excluding India) hold around 400,000 BTC each, while Africa and others hold around 300,000 BTC combined.

Even when all of this is added, it doesn’t come close to challenging U.S. dominance. However, it does show that Bitcoin is truly decentralised.