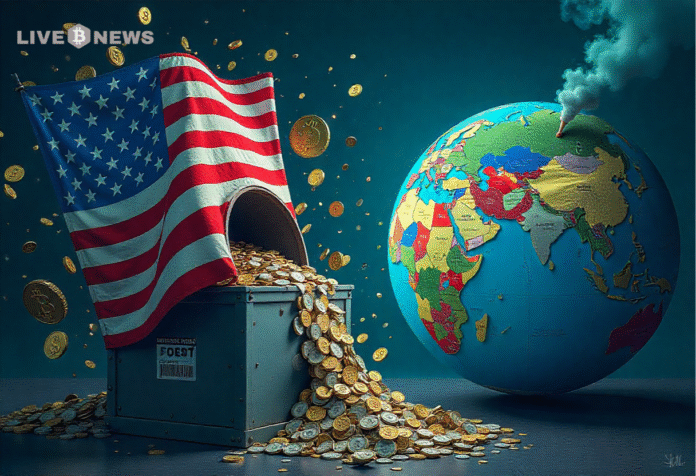

Russia charges the US with the use of cryptocurrencies and stablecoins to extinguish its 35 trillion dollar debt at the cost of the world.

Russia has alleged that the United States uses cryptocurrencies to write off its huge national debt of 35 trillion dollars at the cost of the rest of the world.

Source – X

The allegations were made by Dmitry Kobyakov, a close ally of President Vladimir Putin, at the Eastern Economic Forum in Vladivostok.

Kobyakov alleged that the US would move its debt to stablecoins, which are digital tokens that are pegged to the dollar and devalue it.This would enable Washington to begin afresh and leave the burden to the world markets.

The process of debt transfer was referred to as a crypto-cloud plan by the official from Russia. He said that the action aims to rewrite the rules of the gold and cryptocurrency markets. And he added that it seeks to address the decreased international confidence in the U.S. dollar.

Reset US Debt with Stablecoins?

Kobyakov claims that the decoupling of the dollar from gold in the 1930s and 1970s caused a series of crises. The national debt that the United States is currently facing represents them. Stablecoins have now created a contemporary instrument to control sovereign debt and finance markets.

The consultant detailed the multi-step method that Washington had devised, which consisted of taking the debt liabilities. This places them in dollar-pegged stablecoins, then devaluing those assets and essentially writing off the debt.

This change is in tandem with stricter regulations in the US. The new law, the GENIUS Act, provides regulation of stablecoins that must have full reserve support using cash and Treasury bills. Russia, however, views this structure as facilitating US debt engineering and not financial stability.