US banks laundered $312 billion for Chinese money networks from 2020, while regulators continue to unfairly target crypto.

The period between 2020 and last year has seen US banks process more than $312 billion linked to Chinese money laundering networks.

This update is according to a new analysis by the Financial Crimes Enforcement Network (FinCEN). The agency reviewed over 137,000 Bank Secrecy Act reports and identified suspicious flows with an average of $62 billion per year.

What The Report Shows In Summary

According to updates from this report, there are deep vulnerabilities within the traditional financial system. Banks accounted for $246 billion of the total, and had money service businesses handling $42 billion while securities firms processed $23 billion.

Moreover, these networks are tied closely to Mexico-based drug cartels.

Cartels need to launder US dollar proceeds, while Chinese groups want to bypass strict currency controls in Beijing. These two syndicates, by working together, therefore gain access to the financial resources they need.

How Laundering Networks Operate

FinCEN reported that these groups go beyond drug trafficking. They are also linked to other vices like human trafficking, healthcare fraud, elder abuse and real estate laundering.

Suspicious property transactions alone racked up $53.7 billion.

How can this be…

I was told this only happens in crypto. pic.twitter.com/uukr5vKH7g

— Nate Geraci (@NateGeraci) August 28, 2025

The networks were also found to regularly exploit regulatory gaps. Mexican laws prevent large cash deposits in banks, while Chinese controls restrict overseas transfers. This opens space for criminal partnerships that thrive on weaknesses in banking.

Criminals tend to use counterfeit passports, complicit insiders and money mules to keep operations running. Individuals who open accounts for them tend to list occupations like “student” or “retired” to hide unusually large transaction volumes.

Banks Repeatedly Caught in Scandals

The FinCEN data is not an isolated case either. History shows that banks around the world have repeatedly been used as tools in massive money laundering operations.

For example, Wachovia Bank laundered $350 billion for Mexican cartels between 2007 and 2010 and paid just $160 million in penalties. Danske Bank processed $228 billion in suspicious Russian transactions from 2007 to 2015 and even ignored internal warnings.

HSBC allowed cartels to move hundreds of millions through accounts and paid $1.9 billion in fines in 2012. TD Bank faced over $3 billion in penalties after laundering $470 million for Chinese networks.

The 1MDB scandal funnelled over $1 billion through major banks to fund luxury real estate, yachts and artwork. Finally, BCCI, which shut down in 1991, laundered billions for drug cartels and corrupt governments.

Crypto Still Takes the Blame

Despite the massive evidence of traditional banks handling illegal funds, regulators and lawmakers seem bent on hunting crypto businesses down.

Lawmakers like Senator Elizabeth Warren have repeatedly pushed for tighter restrictions and claimed that “bad actors are increasingly turning to crypto to enable money laundering.”

“Last year, the Department of Justice indicted a Sinaloa Cartel member who laundered nearly $900,000 in crypto.”

What she doesn't want you to know: In the years prior, the Sinaloa & Norte del Valle cartels laundered nearly $900,000,000 in fiat currency through HSBC.

That's a… pic.twitter.com/WPkE8aovq0

— Sam Lyman (@SamLyman33) January 22, 2024

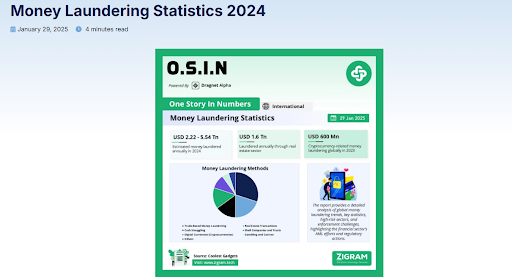

The numbers tell a different story. According to Chainalysis, illegal crypto transactions were only about $189 billion over the last five years.

Comparatively, the UN estimates that more than $2 trillion is laundered every year through the traditional financial system.

TRM Labs reports that crypto-related illegal activity makes up less than 1% of total volume. In fact, blockchain transparency tends to make suspicious flows easier to track, even if they are smaller in scale.